Q1 2024 Earnings Update Palantir (PLTR)

Published: 14 May 2024 by Imaël

On May 6 Palantir released its Q1 2024 earnings update after hours. The stock went down more than 15% the next day. At the time of writing this article, the stock was trading at $20.60. Did earnings warrant the price drop or has the market over reacted? Let’s see what happened.

(Source: Yahoo Finance)

For Q1, the company reported solid numbers. Palantir made $634M in revenue for Q1, up 21% Y/Y and 4% sequentially, exceeding both Wall Street estimates as well as management’s own guidance ($616M at the high-end for Q1). $335M came from government (up 16% Y/Y), $298M from commercial (up 27% Y/Y). Gross profit came in at $518M, representing an 82% gross margin (up 24% Y/Y). GAAP income from operations was $81M, representing a 13% operating margin. This marked the fifth consecutive quarter of GAAP operating profitability for the company. Adjusted income from operations which excludes stock-based compensation and employer payroll taxes was $227M or a 36% adjusted operating margin. GAAP net income at $106M, up 457% Y/Y, representing a net profit margin of 17%. Free cash flow came in at $127M, with a free cash flow margin of 20% (down from 34.8% free cash flow margin for the year-ago-quarter). Q1 adjusted earnings per share was $0.08 (in-line) and GAAP eps was $0.04 (beat by $0.01).

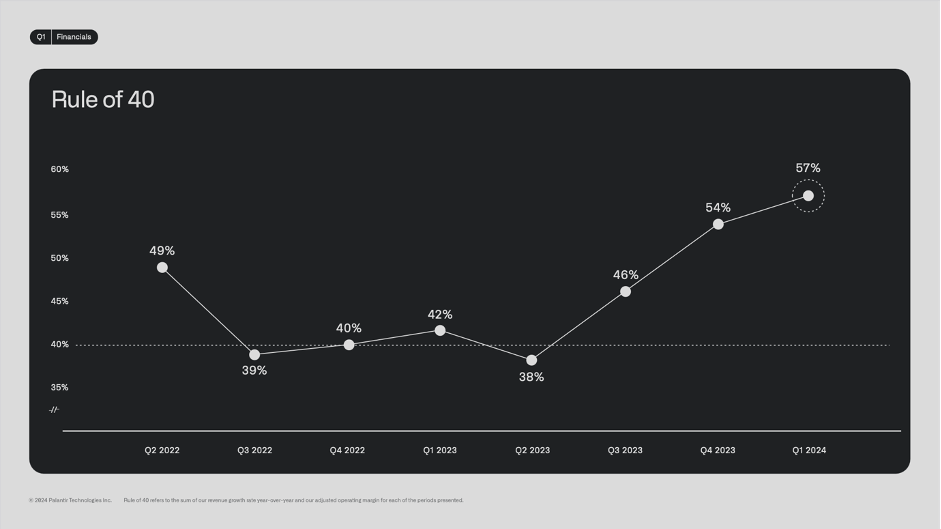

During the call, management was boasting that it had crushed the rule of 40 by reporting 57% (calculated as the sum of its revenue growth at 21% Y/Y and adjusted operating margin of 36% for Q1):

(Source: Business Update of Q1 2024)

In the words of CEO Alex Karp during the earnings call: Palantir is doing the impossible. The company is improving its profit margins while it has kept its expenses for Sales & Marketing almost stable at only 1.2% growth Y/Y, showing us that the company is accelerating.

The rule of 40 is a metric that is widely used to assess a SaaS (Software-as-a-service) company’s health. It implies a tradeoff between growth and profitability, where a company can basically grow its revenue at 30% Y/Y, as long as it has a profitability margin of at least 10%. Likewise, if a company grows its revenue at 60% Y/Y, it can sustain a negative profit margin of negative 20%, i.e., operate at a loss.

In my view, management is putting up a bit of a rosy picture here, as it doesn’t factor in stock-based compensation (SBC) in calculating the Rule of 40. While it is true that it’s a cashless expense similar to depreciation and amortization, it does dilute existing shareholders, leaving them with a smaller fraction of ownership. To undue this dilution, Palantir will at some point have to use cash to buy back shares on the open market. If we would calculate the Rule of 40 before adding back in SBC, the picture would be much less impressive. With 21% Y/Y revenue growth and an operating margin of 12.8%, the company doesn’t even come close to passing the bar of 40: it would then only get to 33.8%.

That is not to say that it’s still impressive to see a 21% growth in revenue Y/Y with sales and marketing remaining relatively stable and the (unadjusted) operating margin growing from 0.8% to 12.8% Y/Y. But not nearly as good as management wants investors to think of the business. It’s definitely something I did not like from the earnings call presentation. I prefer management to be humble and honest about its performance – not making things look better than they really are.

The same could be said for the way it chose to report adjusted gross margins. In Q4 2023, Palantir included a graph indicating adj. gross margin trending up nicely over time. As soon as it went down quarter-over-quarter (from Q4 2023 to Q1 2024) from 84% to 83%, the graph was no longer included in the presentation. In the call, management only mentioned that adj. gross margin was “83% for the quarter” without giving reference to the Q/Q or Y/Y numbers. This kind of reporting feels sub-optimal to me and I’d rather see management be upfront about it.

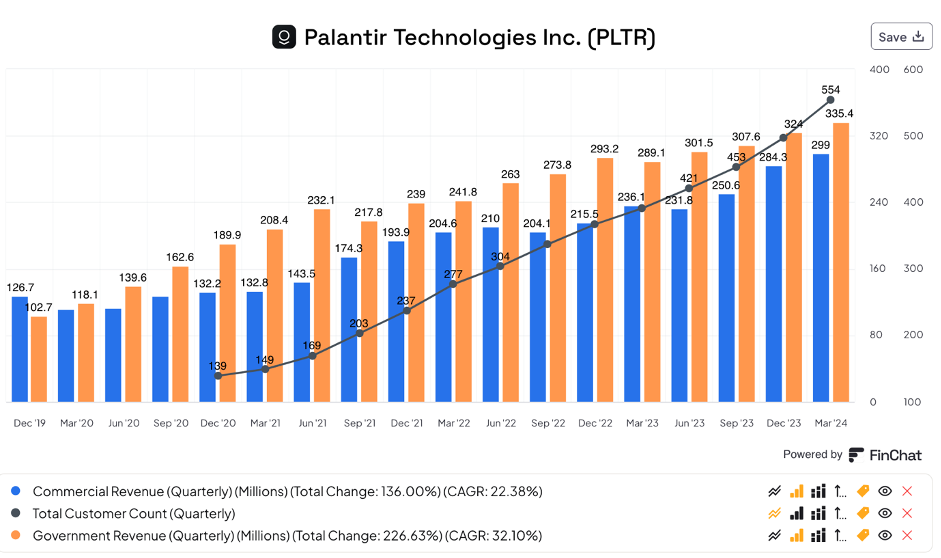

The company held $3.9B in cash and equivalents with no debt, showing a strong balance sheet. Commercial revenue grew 27% Y/Y and 5% Q/Q to $299M, with US commercial growing 40% Y/Y and 14% Q/Q to $150M. Total number of customers grew 42% Y/Y and 11% sequentially to 554 TTM (trailing twelve months basis). Of those, 427 were commercial customers, up 53% Y/Y and 14% Q/Q with 262 from the US, up 69% Y/Y and 19% Q/Q despite Q1 being the slowest quarter traditionally. Of those 262 US commercial deals closed, 87 were at or above $1M (up 36% Y/Y), 27 at or above $5M (up 23% Y/Y), and 15 at or above $10M (up 88% Y/Y).

If we look at the chart below, we can see commercial revenue is catching up with government:

(Source: finchat.io)

For Q1 2024, commercial revenue represented 89.3% of government revenue, compared to 81.7% for the year-ago-quarter. We can clearly see a reacceleration since the launch of AIP after Q2 of last year, telling us that Palantir’s AIP bootcamps are actually working, especially in US commercial. Great to see! The company is now serving companies active in 56 out of the 74 GICS industries (https://www.msci.com/our-solutions/indexes/gics).

With over 915 organizations participating in its bootcamps and seeing 57 new customers added for the quarter as a proxy for its deal cycle from its bootcamps hosted, that gives us a ratio of 1:20. Not bad, but I am looking forward to seeing this ratio improving going forward.

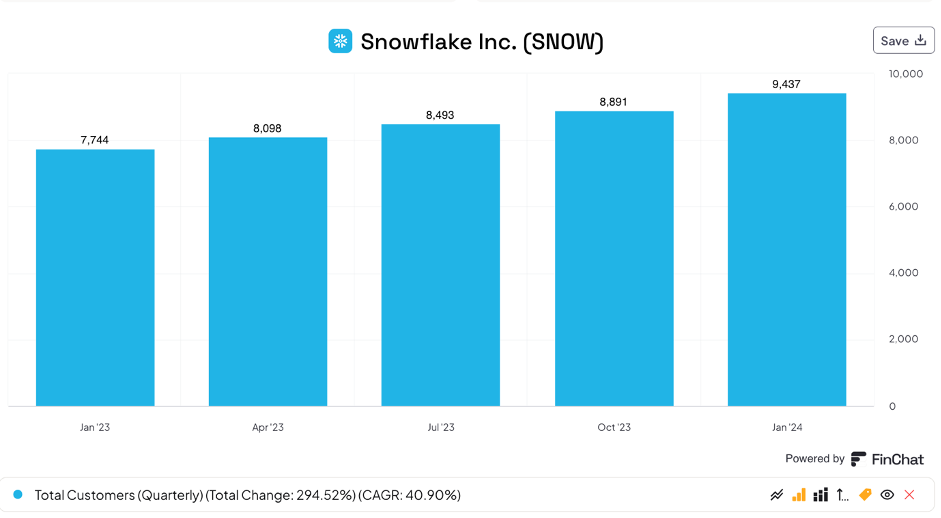

With total customers at 554, I think the company is only scratching the surface of the full potential. If we look at the number of Customers Snowflake (SNOW) is reporting for its quarterly numbers, it’s a whole other universe still with almost 9,500 customers for its latest quarter:

(Source: finchat.io)

Government revenue grew 16% Y/Y to $335M with US government revenue up 12% Y/Y to $257M. As already stated in the Deep dive on Palantir, government revenue can be lumpy. With Palantir being selected as the prime contractor to build the next-gen targeting node for the US government’s TITAN program with a $178M budget in Q4, it’s the first time a software company has won a prime contract for a hardware system, opening the door for vast new opportunities going forward.

Shyam Sankar, the company’s CTO had this to say about the US government market:

“Our growth is being driven by the incredible dynamics of the US commercial market. We believe the US government will follow. With this momentum, we have launched Builder Bootcamps in the US government. The US Army recently issued a memo identifying two Palantir systems, AIDP and Army Vantage as among the 5 total platforms approved for builders.

The US Army’s AI2C (Artificial Intelligence Integration Center) at Carnegie Mellon leverages these platforms for half of their active projects and recently built an application for the 18th Airborne Corps with OSDK.

Our DoD customer recently hosted a Hackathon showing the value of the open Joint All Domain Command and Control or JADC2 SDK that we have been pioneering. One participant commented: nominating targets with GAIA Assist turns a 6-hour workflow into 10 seconds.

We continue to invest in Mission Manager and we’ll be extending it to the Edge with our EdgeX infrastructure in US government.

Now, customers can use their cloud instance as an integrated development environment for Edge platforms, essentially build, test, and continuously deploy and manage multi-vendor big 10 edge ecosystems.

It covers everything from streaming pipelines, OSDK-backed applications, native Gotham applications, and 3rd party apps. We’re excited to deliver on the US Army’s TITAN program. It marks the first time a software company has won a hardware contract, firmly establishing the role of the software prime. We believe the core of this software, Target Workbench, will be critical in every cockpit, every vehicle, every ship.

The Gotham investments in JADC2 performed excellently in meeting the moment defending against the massive Iranian attack on Israel.”

Total Remaining Performance Obligations (RPO) for Q1 was $1.30B, up from $0.94B Y/Y, an 38.3% increase. It reflects the values of contracts that have been entered into with clients, both from government and commercial. They are non-cancelable contracted revenue that hasn’t been recognized yet (this means the actual figure can be much larger still, as everything a customer can still cancel is not considered a remaining performance obligation by Palantir. The difference can be seen when comparing RPO with RDV or Total Remaining Deal Value, which presumes all contracts are fully exercised without cancellations).

Total RPO includes deferred revenue and amounts that will be invoiced. Contracts of 12 months or less are not included in these figures. The fact that RPO is growing at almost twice the revenue growth pace indicates Palantir is building a solid revenue pipeline. US Commercial RDV was up 74% Y/Y and 14% Q/Q, with a total contract value (TCV) of $286M, up 131% Y/Y, which all look really promising for its future revenue growth!

Management indicated it intends to boost its investments towards the US market starting in Q2 through the back half of the year.

For the second quarter, management is expecting revenue of $649M - $653M with adjusted income from operations to come in between $209M-$213M. For Full Year 2024 management guides for revenue between $2.677B - $2.689B, up from its Q4’23 guidance of $2.652B - $2.668B. For US commercial, the company guides for >$661M (up from its Q4 guidance of $640M) with adjusted income from operations between $868M - $880M (up from $834M - $850M) and adjusted free cash flow between $800M - $1B (in-line with Q4’23 guidance). Palantir expects to remain GAAP operating income and net income to remain positive in each quarter this year.

Buy, hold, or sell?

The stock has come down after Q1 earnings came out and remained in the low $20s at the time of this writing. On a fundamental level, the company shows it is executing and US commercial is accelerating. With RPO growing faster than overall revenue growth and US government expected to grow meaningfully over the course of this year, the thesis is playing out nicely. Of course, the stock has had a big runup towards the Q1 earnings release. Even after the price drop to $20.94 as of today, the stock is up 22% YTD still and up 120% TTM. The market is taking a breather. At a forward P/S for the next twelve months of 16.5 the market has priced in high expectations. If you’re still building your position, the recent drop may be a good moment to add as I do not expect the stock to trade at a big discount anytime soon. Over time, the stock will grow into its valuation. Both on the commercial side as well as government, there is lots of momentum and untapped potential. I believe the company is still in its infancy, despite the fact of it being in existence for 20 years already. Its products will grow only stronger over time and there are still many companies out there that could benefit from Palantir’s products (compare the customer count of SNOW vs PLTR above).

I stumbled upon this podcast episode from Bloomberg’s Big Take DC yesterday, in which they explain the development and implications for the battlefield of Project Maven, where Palantir is helping with the software part. It talks about target recognition improvements by AI through human-machine collaboration, much like you and I are being asked to indicate where the traffic lights are located when you try to enter a website and you have to prove you’re not being a robot. Traditionally, the army is employing analysts to go through lots of data and images before reporting to their superiors who then decide on whether to launch an attack or not. You can imagine that this laborious work can be greatly diminished by using AI to find tanks, vessels, or other potential targets. The software grows smarter by getting constant feedback from humans that correct it when necessary. I can highly recommend listening to the episode, which you can find here: https://open.spotify.com/episode/0cskfEsDGvA1nfOPnaxuCp?si=uc0MAE1kRs6jiMiPB-re7g&nd=1&dlsi=c7c50edd9757478f

I have a beneficial long position in the share(s) mentioned.

The information and publication above are not intended to be and do not constitute financial advice, investment advice, trading advice or any other advice or recommendation of any sort. Do your own research and seek independent advice when required. Investing carries risks.