Fastned Deep Dive

Published: 19 April 2024 by Imaël

Fastned (ticker: FAST) is a company that constructs and operates fast charging stations for fully electric vehicles (FEVs) throughout Europe, founded in February 2012 by Michiel Langezaal and Bart Lubbers. Fun fact: he is the son of former Dutch Prime Minister Ruud Lubbers in The Netherlands. Fun fact two: the name Fastned came from Michiel Langezaal, a keen yachtsman, referring to the Fastnet Lighthouse on his beloved Fastnet Rock – the turning point of the celebrated Fastnet Ocean Race. It was initially meant as a working title only, until a better name would come up (which, of course, never happened).

The company’s mission is to provide freedom to EV drivers. At inception in 2012, the company realized electric mobility was the future. To make people start driving EVs, a pan-European fast charging stations network would be a prerequisite. But this would require huge upfront costs, as the adoption rate of electric vehicles was still low in those days – the chicken and egg problem.

What the founders of Fastned realized early on was that by investing early in fast charging stations, it would allow them to secure great locations for years to come, protected by long tenders. This has a very significant value. Today, it seems self-evident that locations are the stronghold of a successful charging business. Back in the days, it was a revolutionary thought. Fastned’s goal is to bring about a European network of 1,000 stations where they sell only sustainable energy from sun and wind.

They want to make this possible by building the fastest fast charging stations for all types of EVs at high traffic locations, delivering renewable energy only, thus building the infrastructure necessary for the EV transition.

Since inception, the company has had a great run thus far: it went from 0 to 297 operational stations, with 135 locations under development. It went from one country to nine, and the company is firing on all cylinders.

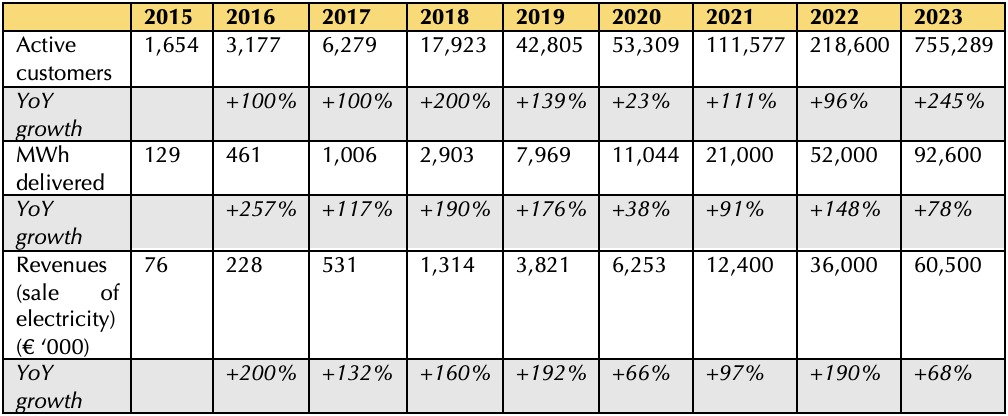

(Source: Fastned annual reports)

The company’s strategy is to acquire rights to develop areas along high-traffic routes, such as motorway service areas (MSAs) that are scalable, for a long period of time to expand its charging network. Location contracts usually have a duration of 15, 20 or even 30 years. These are often owned or regulated by governments. Fastned is actively advocating for transparent, competitive tenders, for which they have a track record of winning them.

Where highway locations are not in the hands of governments, like in the United Kingdom, the company engages with private landowners, trying to acquire locations at or near highway exits. They obtain relevant permits and procure a grid connection and manage the building process themselves, acting as the main contractor. The modular stations, designed in-house, to ensure a visible brand, allow for an efficient build and expand process.

(Source: Fastned)

Apart from the design of their stations, Fastned prides itself in developing almost all of their processes in-house. The company is being run on their own developed software backbone on which it runs its data driven infrastructure. This way, they have all the know-how and vertical integration necessary allowing them to learn, improve, automate and scale their business.

When they started out, there was no off-the-shelve software backend to manage its charging network with. There was no call center specialized in charging services. By starting early, Fastned internalized all these crucial aspects, enabling them to offer a user experience that stands out from its competitors. Their consistently high Net Promotor Score of 60 (bordering ‘excellent’) and high charging network experience reviews that rank Fastned second-best after Tesla’s Supercharger network bear testament to this.

(Source: Zapmap Best EV charging networks 2023 rapid/en-route)

With production of EVs ramping at car manufacturers, adding just more charging points on the map won’t be enough to keep up with demand. Early EV drivers, being more affluent, often had a charger at home. Over time, with more and more people buying EVs, this solution will work less and less for consumers as the majority of people don’t have their own driveway. This requires a public infrastructure to refill their car’s batteries. For the Netherlands, some 70% of people will have to depend on public charging infrastructure, in Germany or the United Kingdom, the number is about 50%.

In come scalable fast charging stations that Fastned is rolling out, where hundreds of vehicles per day can charge their cars. Slow AC charging poles that still make up the majority of the European EV charging infrastructure are very difficult to scale, as one charging pole can charge only a handful of EVs on a daily basis. Public slow charging is also difficult to make profitable as the aim is to roughly sell electricity at purchase price. That’s why the need for fast charging is accelerating even faster than the charging market as a whole.

New EV models are charging faster and faster. When Fastned started in 2012, the charge speed of the fastest charging car was the Nissan Leaf, at 50kW. Today, cars like the Porsche Taycan and Tesla Model 3 can charge at 250-270kW*. This matters, because no matter the capacity of the fast chargers at the stations, the speed by which a car battery can be recharged depends on the kW of the car’s battery. So, if the charging speed of the car is 50 kW, it will never be able to charge faster than that, even if the fast charger can deliver 300 kW.

The European charging market will grow exponentially in the coming decade, moving from roughly 4 TWh in 2020 to about 90 TWh by 2030, scaling the market by ~20x. In 2023 Fastned sold 99.6 GWh of energy to its customers. To get to ‘only’ 1 TWh, it would have to grow its 2023 output by 10x already – giving you a sense of how big of a market it is operating in.

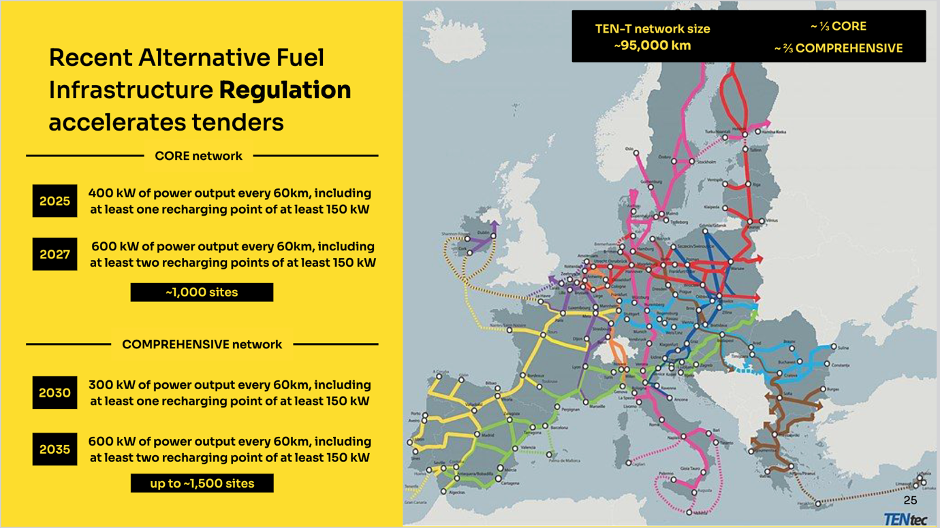

This is stimulated further by the new EU Alternative Fuel Infrastructure Regulation (AFIR), which stipulates that for its TEN-T core network of motorways, by 2025 every 60 km needs to be equipped with a 400 kW power output, and a 600 kW power output for every 60 km by 2027. For its TEN-T Comprehensive network, a 300 kW power output is required at every 60 km by 2030, with a 600 kW power output every 60 km by 2035 (see image below).

Home charging will continue to be a popular means of charging but its share in the total charging mix will decrease. With public fast charging the fastest means of charging, this will be expected to capture most of the growth. From 0.5 TWh in 2020 to more than 25 TWh in 2030, scaling ~50x.

(Source: Fastned Investor Presentation, February 2024)

*) For those of you who get confused between those kW’s and kWh’s: a kW refers to the power of an electronic device. The more powerful the device, the higher the number of Watts, kilowatts, megawatts, etc. A kWh is a measuring unit of electric energy. It refers to the consumption of the device. For example, 1 kWh corresponds to the energy consumption of an electronic device of 1,000 Watt or 1 kW for the duration of 1 hour).

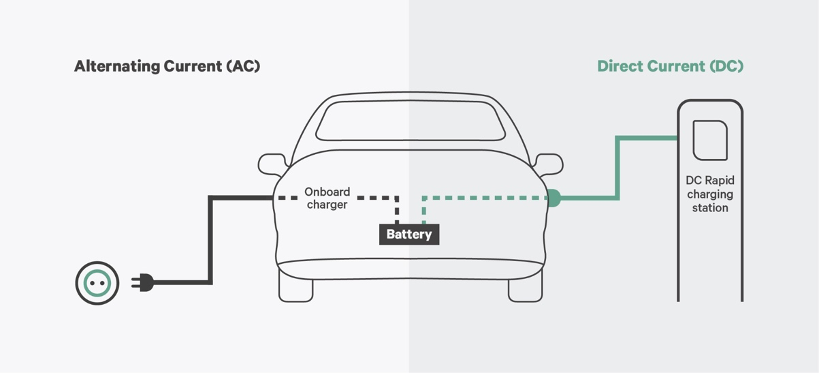

What is fast-charging and how is it different from ‘regular’ charging? All batteries – including those of EVs, use Direct Current (DC) for charging and discharging. But the electric grid delivers Alternating Current (AC). Therefore, AC from the grid needs to be converted to DC in order for it to be used to charge the battery. This is done by an AC/DC converter.

The converter is part of the charger. A charger can either be integrated into the vehicle as an onboard charger, or it can be external to the vehicle (as is the case with the fast chargers at the Fastned stations). Today, nearly all EVs have a small onboard charger. The driver can use a cable to connect the onboard charger to a regular AC socket next to their driveway or plug it into a public charge point. The charge point then delivers the AC required for the onboard charger to charge the car’s battery.

If you want to charge faster, the AC/DC converter, and hence the charger, needs to be bigger. But a bigger charger is also heavier, takes up more space in the car and adds complexity and cost to the vehicle. On top of that, every component in a vehicle needs to be automotive grade to ensure its reliable operation for the lifetime of the vehicle. So, car manufacturers often opt for a relatively small – and thus slow – onboard charger to optimize between these factors.

(Source: wallbox.com)

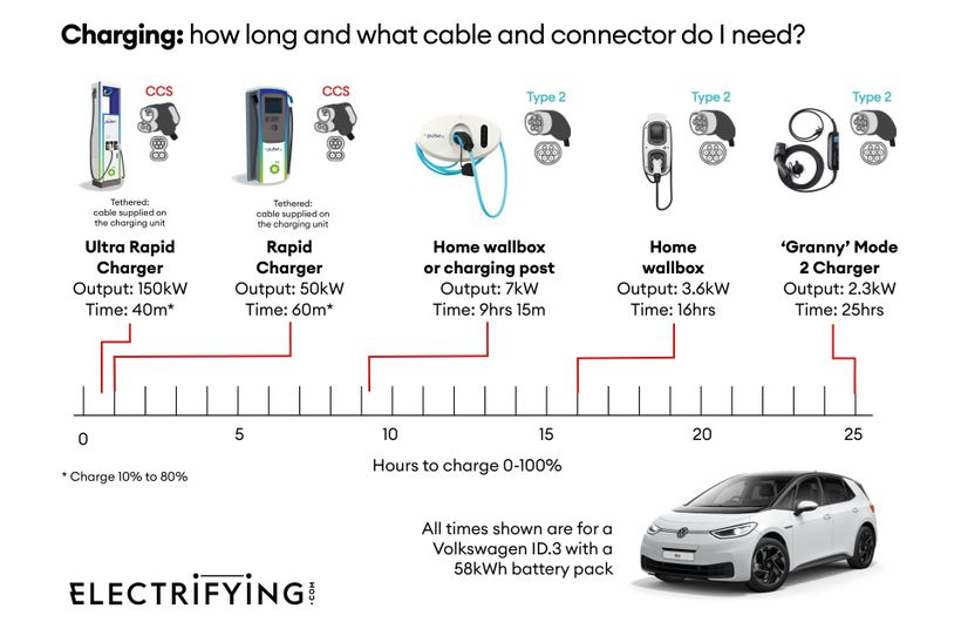

An external charger that does the AC/DC conversion can be a lot bigger, heavier, more complex and more expensive than an onboard charger, but it is also a lot faster. A typical fast-charger delivers 300-400 kW, which charges a vehicle about 25-80x faster than an onboard charger. Below you can see what the difference means in time needed to charge your car’s battery using the different chargers:

(Source: electrifying.com: Ready, willing and cable - the essential guide to EV connectors and charging)

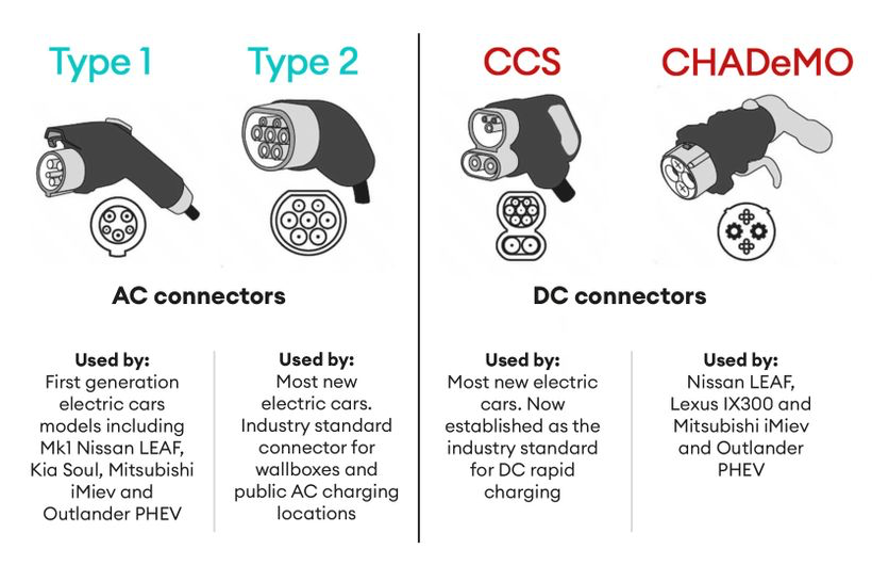

Fastned’s charging stations use CCS and CHaDeMO connectors for fast charging. Type 1 and Type 2 connectors you see below are used for AC (slow) charging, with Type 2 being used by most modern EVs. With fast charging, CHaDeMO was the original connector that would allow for DC (fast) charging, but has been overtaken by the CCS connector as the new industry standard since then. While most EVs nowadays will be fitted with a CCS charging port, almost all public fast chargers are still equipped with both CCS and CHADeMO connectors to facilitate all EVs that have inbuilt fast charging connectors.

(Source: ibid.)

Fastned aims to create a network of at least 1,000 fast charging stations across Europe. There are 4,000 MSAs in Europe that tick all of the boxes Fastned is looking for. Next to MSAs, there are some 100,000 locations of strategic importance along high-traffic roads, both public and private.

From the 4,000 (public) MSAs, some 30-60% of the available locations have been put up for tender. This leads to an opportunity of about 2,000 locations for Fastned. Depending on its success in winning those tenders when scaling abroad, the company aims for some 200 to 600 new locations, or a win rate of 10-30%.

Next to the MSAs, there are strategically important public land opportunities (mainly located within cities). Iconic examples of these are projects such as the Energy Superhub Oxford, Europe’s biggest project to date, were Fastned shares a site with Tesla and Wenea.

Regarding private land, there are over 100,000 private grounds that tick Fastned’s boxes. Many of these location owners will look for a partner that will offer a charging concept that is interesting for EV drivers.

Thanks to Fastned’s early start and experience, they’ve built a great fast charging concept with which they have proven to deliver a better charging experience than other players in the market. This positions them to win tenders and private location deals better than others. In France, for example, the company won over 25% of the tenders in a market where they had to compete against big French oil companies and German car manufacturers.

Whether in France, Belgium, or Switzerland: Fastned consistently is showing it is able to get high win rates. As tender requirements are becoming stricter with charger uptime, repairs on chargers and penalties, Fastned is doing significantly better than the top-5 competitors. This is being recognized by the relevant authorities. Through its operational excellence and ability to scale, Fastned is quickly becoming one of the dominant players in the market.

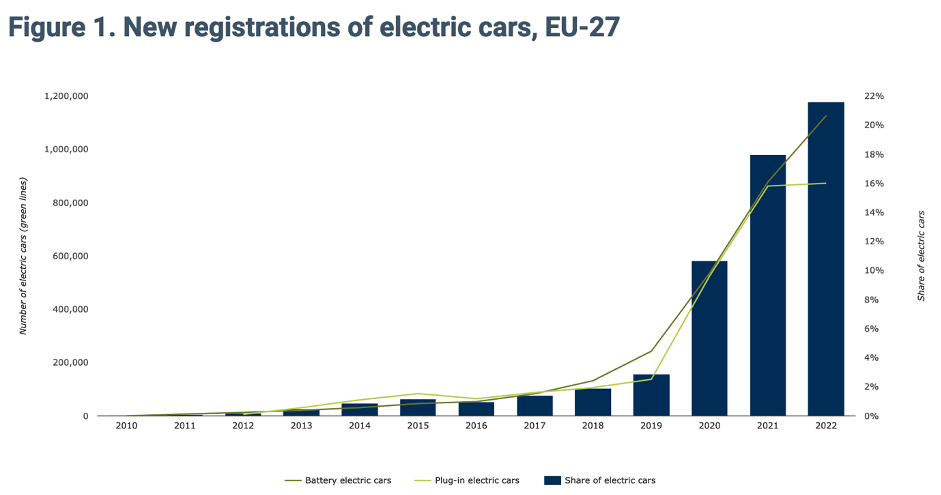

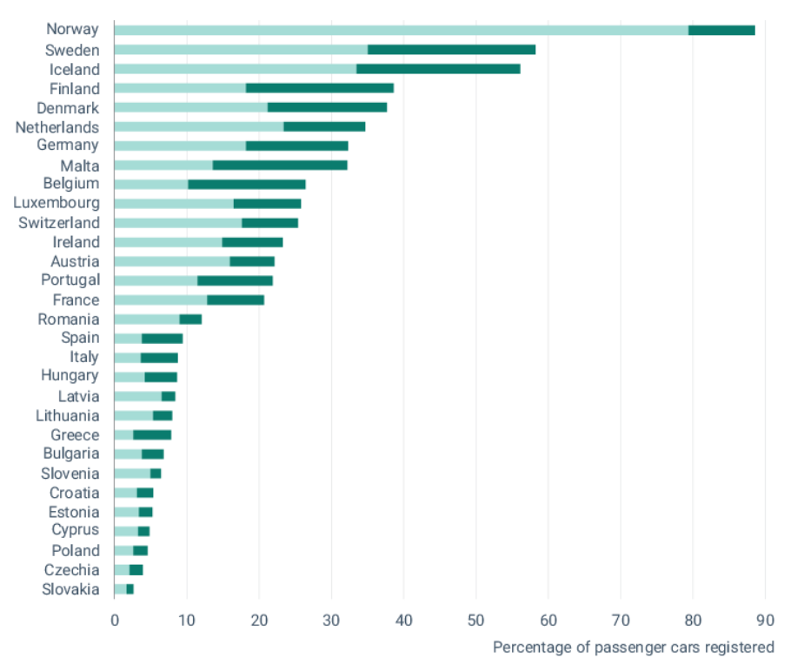

The share of EVs in new car registrations for the EU stood at 21.6% of total new car sales, growing rapidly from previous years. It is expected that soon all new cars sold will be FEVs as EU legislation prohibits the sale of ICE cars by 2035. Many countries have pulled this deadline forward (the UK to 2030, in Norway ICE vehicles are no longer allowed to be newly sold by 2025).

From then on, it will take about two decades before the entire car stock on European roads will be fully electric, as cars are used for about 15-20 years. This means the charging market will be a growth market for several decades to come.

(Source: European Environment Agency: New registrations of electric vehicles in Europe)

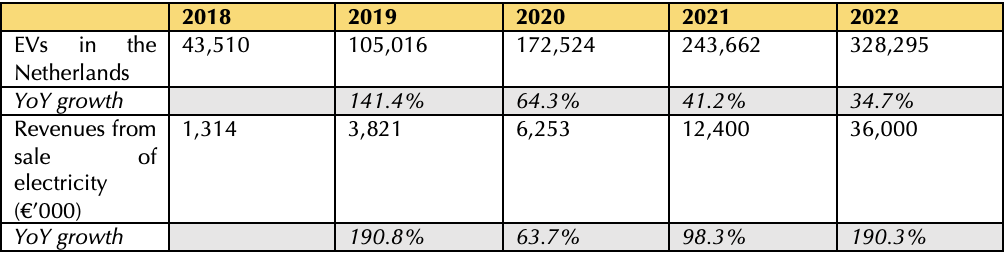

Will fast charging outpace other means of charging and will high traffic locations be able to capture that growth? When taking the Netherlands as a case study, we see that Fastned’s revenues are growing faster than EV adoption. This seems to confirm the thesis that the demand for fast charging will increase as the ability to charge at home will become increasingly difficult with growing EV share to total car fleet:

(Source: RVO/Netherlands Enterprise Agency, EV Statistics, January 2023 and Fastned Annual Reports, author’s calculations)

Does location matter when it comes to fast charging? When looking at the data, it seems to be the case:

(Source: Fastned Charging Day presentation, 2022)

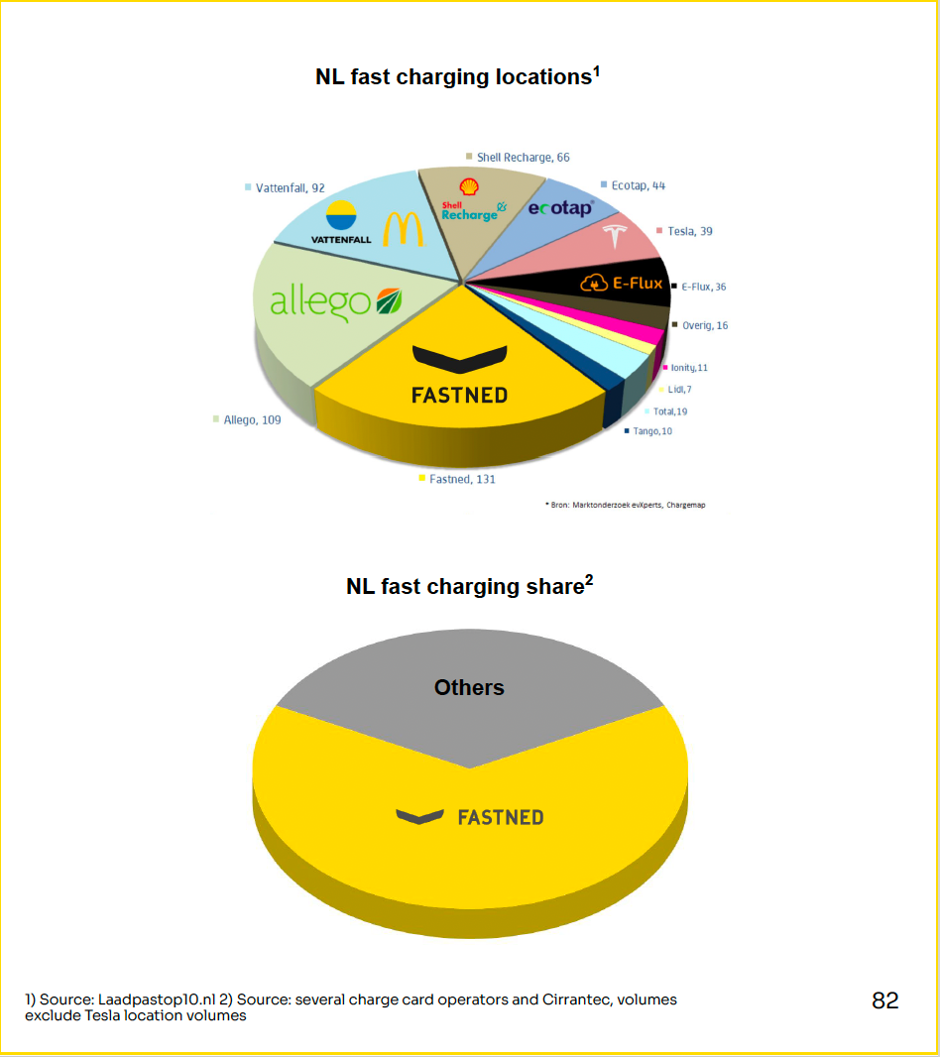

When looking at the pie chart on top of this slide, Fastned has a 20-25% share of fast charging locations. But when looking at the pie chart below, Fastned captures over 60% of the fast charging volume. This means the company makes more than 5x the number of sales compared to the average charging locations of other charge point operators.

This is largely due to the fact that Fastned operates the highest traffic locations in the Netherlands on Dutch motorways. People want to charge where they drive, as it’s the most convenient. It is exactly for this reason that petrol stations sell more volume on motorways as compared to petrol stations located on secondary roads and in villages.

The Dutch stations operated in Fastned’s network have about 30,000 cars driving by on average. In 2014, 0.1% of those cars were fully EV, or about 30 cars driving by on a daily basis. Of those 30 cars, about 5% stopped and charged at the station, leading to 1-2 charging sessions per day. This ratio has remained constant with EV growth to total car fleet. In 2021, Fastned registered 22 charging sessions per station per day on average, or a 10x increase – despite 2021 being a Covid year.

By 2030, it is estimated that 20% of those 30,000 cars should be fully electric or 6,000 EVs driving by on a daily basis. With capture rates remaining constant, that translates into 250-300 charging sessions per day per station. For 250-300 charging sessions a day, a station requires 8-10 chargers running at a very high utilization rate.

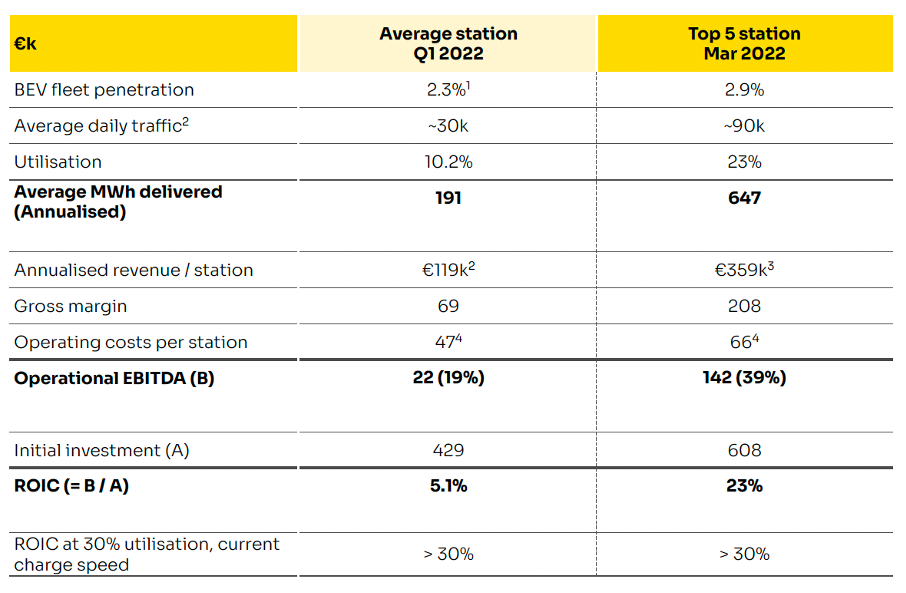

Annualized revenues per station for Q1 2022 was about €120,000 for the average station and about €360,000 for a top-5 station. Station sales are driven by EV traffic. Fastned’s top-5 stations have 3x more general traffic, meaning 3x more EVs driving by, meaning it has 3x more sales than Fastned’s average stations.

(Source: Charging Day Presentation 2021)

(Source: Fastned Trading Update Q4 2023)

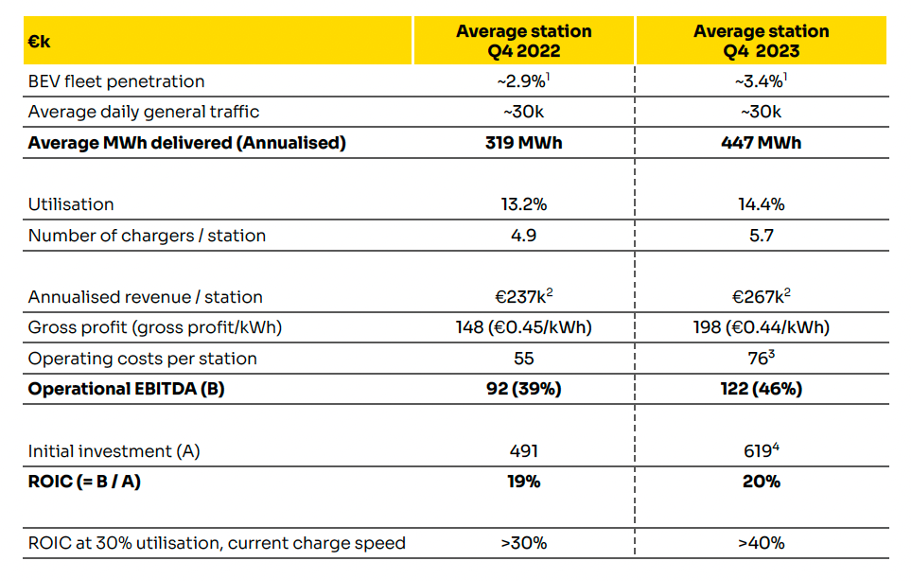

From this comparison, you can see that with increasing BEV fleet penetration of just 0.6% from Q1 2022 to Q4 2022, station utilization improves by 3% from 10.2% to 13.2% with average daily traffic remaining equal. With BEV fleet penetration increasing from 2.9% to 3.4% by Q4 2023 in the markets where Fastned is operational, station utilization improves from 13.2% to 14.4%.

Average MWh delivered increased even more meaningfully during the same period: from 191 MWh on an annual basis in Q1 2022, to 447 MWh in Q4 2022, an increase of 134%. This translates into revenue growth from €119.000 per station in Q1 2022 to €267.000 in Q4 2023, an increase of 124%. Gross margins improved from 69% to 74% for the same period, and operational EBITDA went from €22.000 per station in Q1 2022, or a 19% margin to €122.000 in Q4 2023, equal to a 46% EBITDA margin.

Clearly, the profitability of Fastned is still in its infancy but the company is firing on all cylinders and with 297 stations in operation with a total of 432 secured locations, there is a lot in the pipeline that will materialize into the path towards profitability and increasing margins, as the company has demonstrated clear operating leverage.

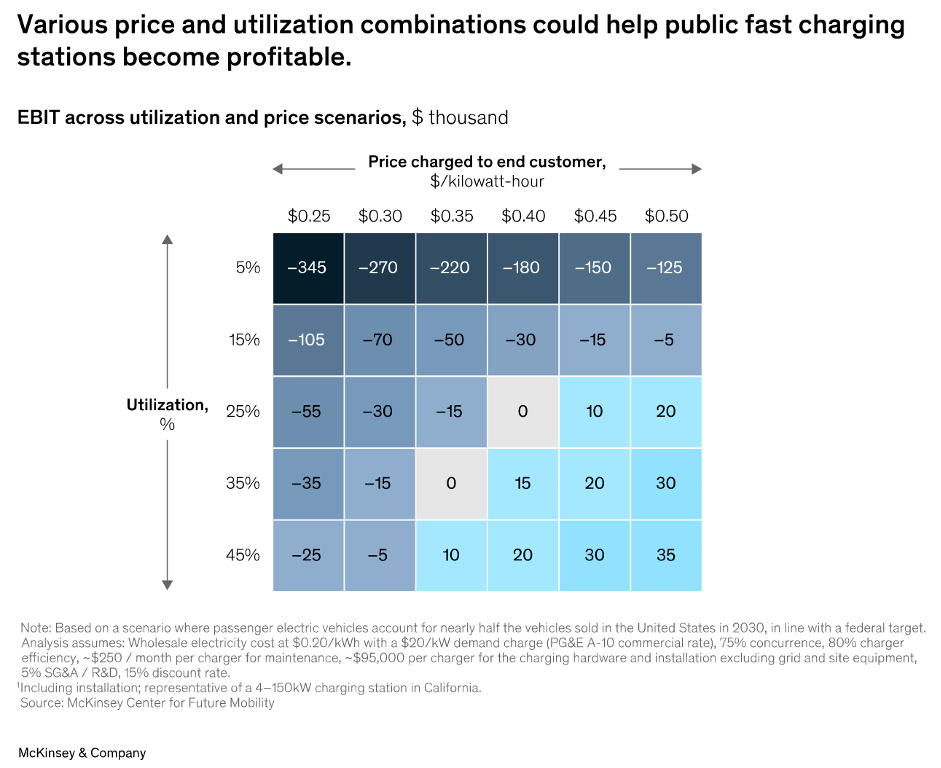

A price-and-utilization model by McKinsey (for the US EV market), shows how higher utilization rates can quickly lead to much higher earnings:

(Source: McKinsey & Co: Can public EV fast-charging stations be profitable in the United States? Oct. 5, 2023)

Fastned’s top-5 stations have an operational EBITDA margin of close to 40% due to their higher utilization, showing the potential earnings power for its average stations at 3x more EV penetration. This is expected to materialize by 2025. When adding increased session sizes due to increased charging speeds, this potential will improve even further. With revenues going up, driven by EV growth and larger charging sessions, all stations are expected to show numbers similar to the top-5 stations in a couple of years from now.

Long term, revenues per station are expected to grow to €1M by 2030. In Q1 2022, about 2% of vehicles on average were fully electric in the markets where Fastned operates. By 2030 this number is expected to have grown tenfold. Revenues for 2022 are above €100,000 annually per station. Dutch research agency TNO estimates a 20% fleet penetration by 2030, forecasting 2.5 GWh fast charging demand on average across Dutch MSAs. This amounts to €1M in revenue per station.

Fastned is operating in a competitive market that will further attract new players as FEV adoption will further accelerate in the coming years. Most charge point operators (CPOs) operate locally (for example GridServe has CPOs only in the UK, Enel in Italy, EnBW mainly in Germany) and only a few are truly pan European oriented.

Ionity (a joint venture of BMW, Ford, Mercedes, VW Group, Hyundai, among others) and Allego having some of the most extensive networks as of yet and both are growing fast, although much of Allego’s infrastructure is dedicated to slow charging. This shows up in their numbers, as we learned previously that AC charging is much more difficult to scale and make profitable. Their gross margins are in the mid-teens whereas those of Fastned hover around 70%. Ionity is growing fast, also on prime locations, with the backing of some of the major OEMs (who need a fast-charging infrastructure to drive their EV car sales). They are expanding rapidly and a contender to recon with, although their customer user ratings consistently end up quite a bit lower than those of Fastned.

Then there are legacy petrol station players who try to pivot towards the EV fast charging infrastructure, such as Shell and BP. Much of their success will depend on national and EU legislation. In the Netherlands, for instance, in August 2021, the Dutch Council of State has ruled that there is a limit to the number of charging poles that petrol stations may install. In other cases, Dutch court rulings have established that as the concessions given out at the time to petrol station operators were explicitly meant for selling petrol and other substances that could be burned. Alternative propulsion technologies such as electricity were not taken into consideration when the petrol station owners participated in the tender bidding process. The fact that until that moment gas station owners also had not taken any initiative towards realizing charging facilities did not help their position either in this court case.

In order to compete with Fastned, legacy players will thus have to join tenders designated for exclusive fast charge locations, to which they have been reluctant for a long time: earning them free rider allegations by Fastned, not entirely unwarranted.

Today, they do realize they will need to join the fast charging infrastructure land grabbing that is going on if they are to profit from the seismic shift to FEVs that is taking place. Chances are, they are too late already.

It is clear Fastned will not end up being the sole player in the fast charging field, far from it. Competition is fierce and increasing rapidly, also by players with much bigger pockets than Fastned who have finally started to realize the huge potential for this market. In 2013, Fastned obtained 201 concession locations in the Netherlands with a right of lease of 15 years, so the first new tender biddings are about to come by 2028.

While this may sound risky as competitors may bid for the locations to grab a share of this fast-growing market once a new tender is open, it is highly likely the stations Fastned currently holds will remain doing so after 2028. That is because of how the tenders are being organized – at least in the Netherlands: if the incumbent has the highest bid for its location, he will only have to pay 30% of the bid price to obtain the rights for another 15 years. This gives them an enormous advantage against its competitors and puts Fastned in a very strong position.

One of the key risks is in their international expansion, Germany in particular. The success of Fastned hinges on acquiring prime locations protected for long terms by public tenders, ideally for 15, 20, or even 30 years. The German motorway tender process is an ugly one in this regard, as its MSAs are operated almost exclusively by Tank & Rast, owning some 95% of all fuel stations along the German highways.

Fastned, together with Tesla, have taken the case to the German Federal Anti-Cartel Office, but this institution did not see any objection to the current monopoly position of Tank & Rast within the current concession agreement. The case was brought before the Higher Regional Court in Düsseldorf, who suspended the trial to get advice from the European Court of Justice (ECJ) in Luxembourg on how far this concession agreement reached.

While Fastned successfully won similar cases before Dutch courts earlier, it remains to be seen if the ECJ will arrive to a similar ruling. In the Pressetext-judgment, the ECJ has for the first time provided an assessment framework for assessing the change of a contract during the tender procedure and when this requires the obligation of opening a new tender procedure. This is the case when a material change occurs, namely when:

Conditions are introduced which, if they had been mentioned in the original tender procedure, might have led to: admission of tenderers other than those originally admitted;

The choice of a different quotation than the one originally chosen;

The assignment is significantly extended to services that were not originally included;

The economic balance of the contract is changed in the contractor’s favor in a way not intended by the terms of the original contract.

Until then, Fastned partakes in biddings for tenders of Autobahn GmbH. During the second part of the charging tender, Fastned managed to win one out of six nationwide lots, containing 34 new sites, mainly located in the northern half of Germany, where it will install 400 kW charging points.

During the first part of the regional lots, it won two lots in September 2023. E.ON and TotalEnergies both won three of them. Of course, this is great news for Fastned, allowing them to build fast charging parks directly on German motorways directly for the first time. But the tender to build at unmanaged highway park and rest areas does not allow for building shops or restaurants or to upgrade sanitary facilities – all important aspects to make the area more attractive and improve the customer experience:

(Source: Drees & Sommer)

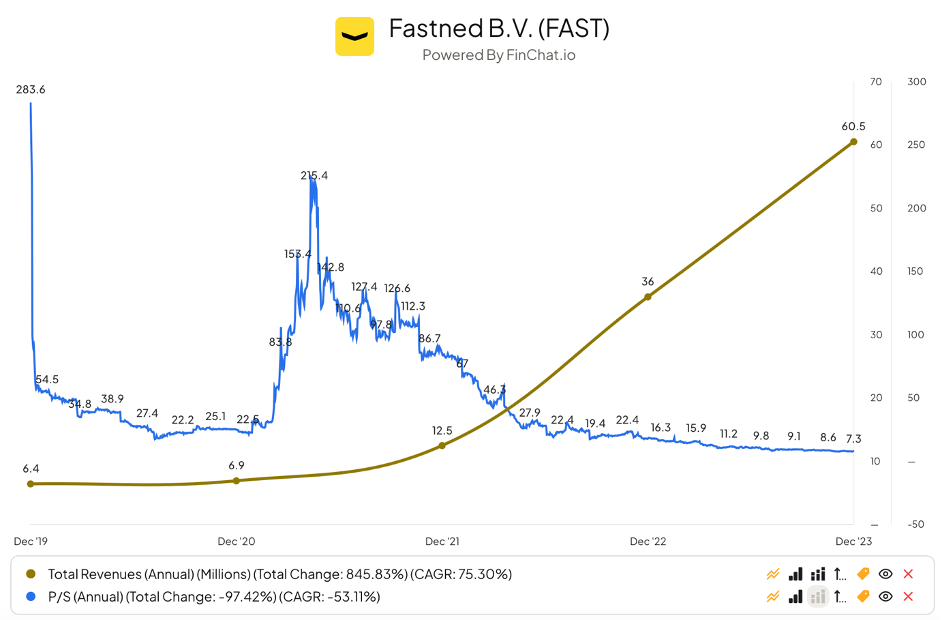

Fastned’s shares trade at €23.30 with a market cap of €443M. Total revenue is €60.5M for 2023 (+68% YoY). As the company is still unprofitable, it makes most sense to look at its P/S ratio. Currently, Fastned is trading at a P/S of 7.3, looking quite attractive from a historical perspective:

(Source: finchat.io)

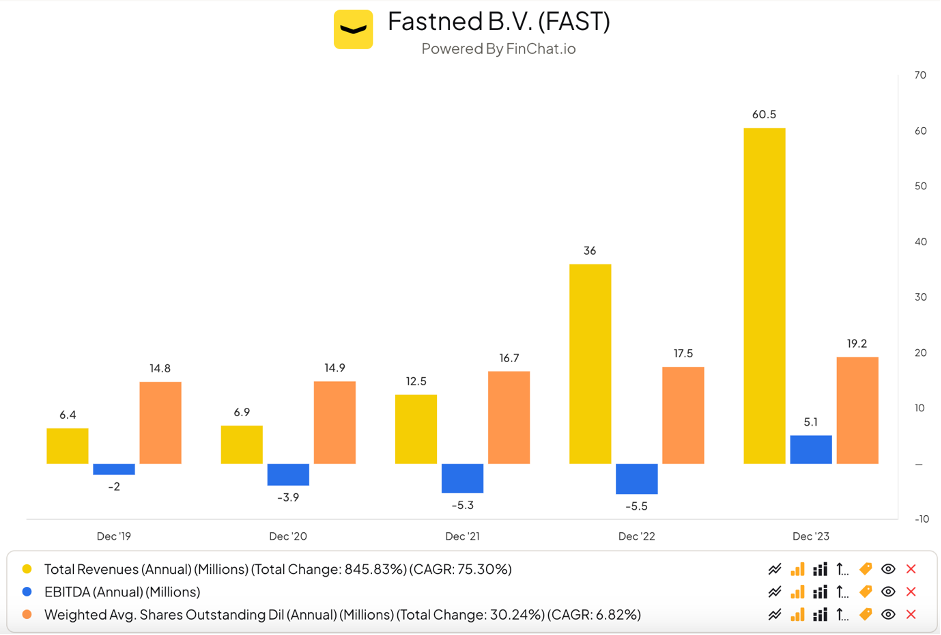

In terms of profitability, the company has a gross margin of 74.2% but at an operational level, it is still losing money with operating margins at -20%. Underlying company EBITDA was positive with €7.8M i.e., a 12.9% margin. Net margin is still -31.9% as the company is in hyper growth mode, grabbing as much valuable spots along the key motorways as it can get.

Over time, operating, EBITDA and net margins should improve significantly as we’ve seen at station level economics unfolding before. The company has strong operating leverage which kicks in with BEV growing moving forward.

Fastned has demonstrated strong revenue growth over the past few years with a 3-year CAGR of 69.2% and a 5-year CAGR of 56.7%, meaning revenue is growing (much) faster than the EV adoption rate.

Shareholder dilution has been trending up over the years at 6.8% CAGR. This is to be expected, given the expansion phase the company is in. In 2023, the company turned EBITDA positive for the first time at €5M (an 8.5% margin) and management has stated during its latest Trading Update (Q1 2024) that it expects EBITDA to remain positive for this year and expects operational EBITDA margin to come in at >40% by year end 2025. For 2023 stock-based compensation was €3.2M or 5.4% of revenue, up from €0 in 2022.

(Source: finchat.io)

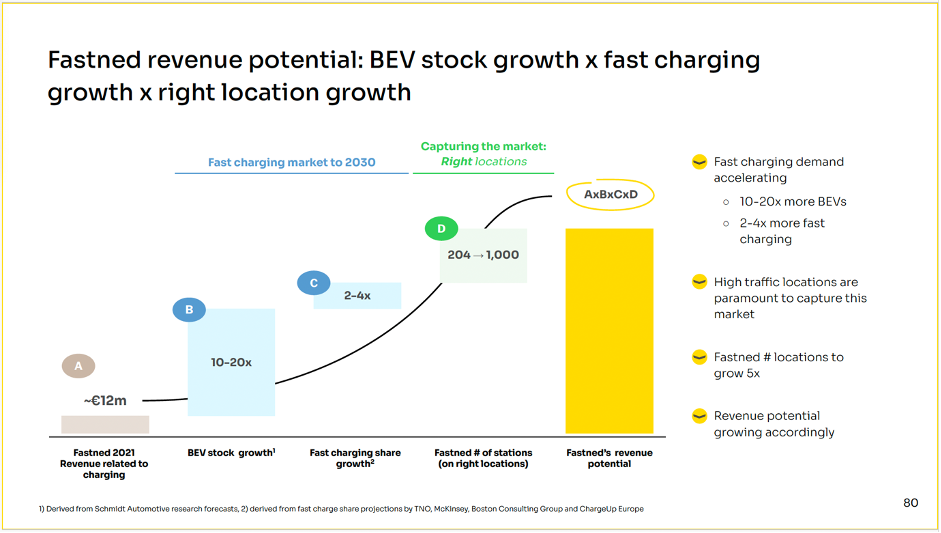

The way to think of Fastned’s revenue potential, according to management, is as follows. At current levels, the market is set to grow by 10-20x in BEV market share between today and 2030. In frontrunning countries such as the Netherlands, where BEV market share is already quite high, the upward potential is about 10x, in countries that are adopting more slowly, there’s a 20x growth potential.

Fast-charging share growth will 2-4x, as utilization rates will increase due to the fact that late adopters will have less possibility to charge at home (depending on the country, around 40-70% of households do not have access to off street parking), making the share of fast-charging go up. Fastned aims to have 1,000 stations operational by 2030, against 297 as of today, a further 3x increase. Multiplying these gives us Fastned’s 2030 revenue potential.

(Source: Fastned Charging Day Presentation, 2021)

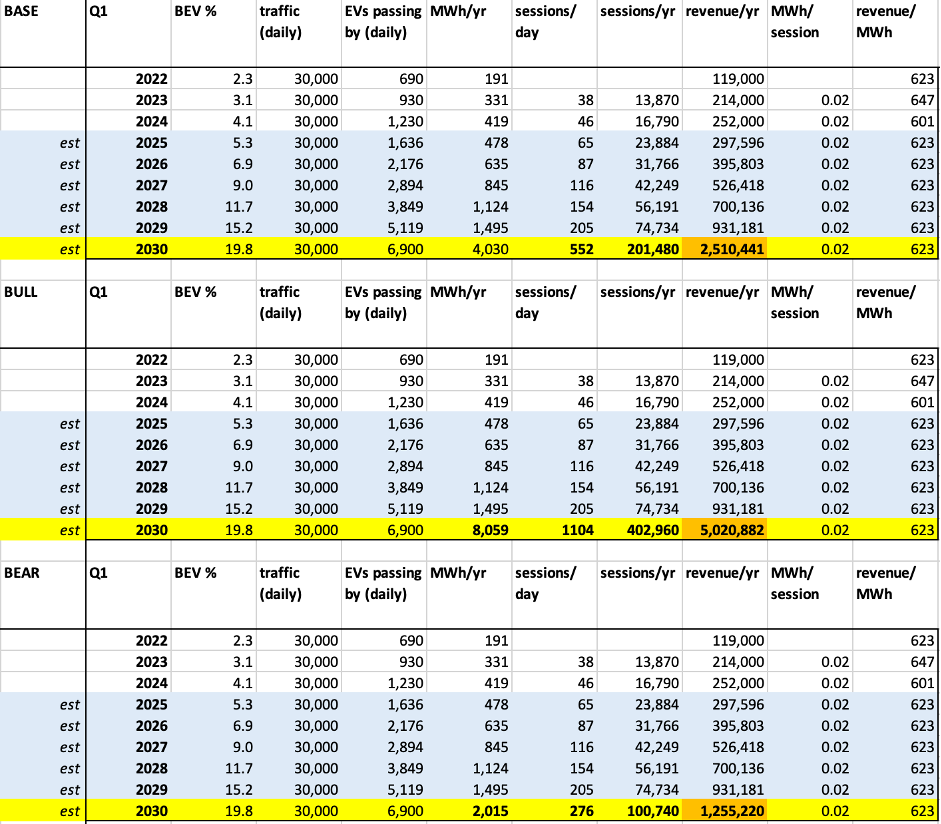

Using station metrics the company provides for its quarterly updates, I’ve come up with the following bear-, base-, and bull-case estimations for the company’s revenue by 2030:

(Source: author’s calculation based on Fastned’s quarterly Trading Updates)

Note that I have kept the growth rate in BEV fleet share constant at 1.3x annually, following the trend of the past three years. This way, we arrive at a 10x increase from today’s levels. I’ve kept all other metrics constant, except for charging sessions per day. If management is correct that the share of fast charging will have to grow as more and more people switch to EV driving, this will increase sessions/day substantially. To me, this seems highly likely as a majority of drivers that didn’t belong to the early adapters won’t have access to off street parking and thus will have no or limited opportunity to charge at home or in their streets.

(Source: Fastned Charging Day 2022 Presentation)

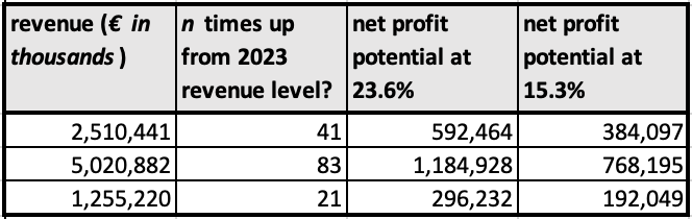

For the base case I assume sessions/day relative to BEV fleet penetration to grow 2x at 8% of average daily traffic. For the bull case, I doubled that to 16%, for the bear case scenario I am assuming management was wrong and the percentage of car drivers passing by for a charging session will remain constant with today’s numbers, which are around 4%. If we go with these assumptions, that means Fastned is looking at a potential annual revenue ranging from €1.2M to 5M annually by 2030. In other words: a 21-83x from today’s revenue levels.

To estimate net profit potential for 2030, I took net profit margin levels of the Oil & Gas distribution (23.6% net margin) and Green & Renewable energy (15.3% net margin) industries as a proxy as reported by Aswath Damodaran (you can look them up for yourself here: https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/margin.html)

(Source: author’s calculations)

With the market set for years of increasing BEV market share, Fastned is poised to be making a lot of increasing and recurring revenue. While on the surface, operating a fast-charging station network along Europe’s main motorways seems like an easy to copy business, the company has some very strong advantages that give it its competitive moat.

Its customer user experience is second to none, it has installed a strong base at a time when there was still little competition, gaining the best locations and thus having built a strong network with an even stronger branding. Its iconic solar tree canopies with bright yellow arrows on top that welcome car drivers along the highway, while hard to put a number on, shouldn’t be underestimated in my view. They will ensure Fastned to be top of mind for car drivers when they think ‘fast charging’. As a bonus, they signal ICE car drivers that there is an alternative ready if they want to switch to EV driving.

Add to that the fact that they manage everything under one roof, from design of stations to gaining land and building permissions to construction works to the monitoring and maintenance of their stations: combined it gives them very strong data insights that they can leverage to improve their business even further. The fact that they have been early movers, also gave them a big advantage as it allowed them to consult with key stakeholders at the government levels on how to think about the build out of a strong fast charging infrastructure necessary to drive EV adoption among car users and to reach the EUs climate goals.

They operate in a market with very strong, secular tailwinds for years to come and if they keep operating the way they have been doing up until now, I see a very bright future for Fastned going forward.

I have a beneficial long position in the share(s) mentioned.

The information and publication above are not intended to be and do not constitute financial advice, investment advice, trading advice or any other advice or recommendation of any sort. Do your own research and seek independent advice when required. Investing carries risks.