palantir deep dive

Published: 6 May 2024 by Imaël

Palantir Technologies (ticker: PLTR) is an American company that builds foundational software for organizations, both within governments as well as commercial, to effectively integrate their data, decisions, and operations at scale.

The company was founded in 2003 by Peter Thiel, Nathan Gettings, Joe Lonsdale, Stephen Cohen, and Alex Karp and became publicly traded in 2020 through a direct listing. The company’s name, as well as its logo, are derived from Tolkien’s The Lord of the Rings, where the magical palantíri were “seeing-stones”, described as indestructible balls of crystal used for communication and to see events in other parts of the world.

Starting with software to help the US intelligence community and the Department of Defense (DoD) to assist in counterterrorism investigations and operations in response to the 9/11 terrorist attacks, the company was and still is somewhat secretive and controversial, being (wrongfully) regarded as a scary ‘data octopus’ by many. What Palantir realized early on was that to handle the new terrorist threats against the West that became apparent after the 9/11 attacks, existing technologies and approaches failed to deal with adaptive, non-static adversaries. If finding and stopping the terrorists would mean a tradeoff between giving up Western civil liberties and providing security, that would make it a hard to win battle.

What it came up with, was a software product that would allow for a non-algorithmic, non-static interaction with large swathes of data, allowing the analysts to interact with the data in a machine-assisted analysis to see patterns before the terrorists would even realize they’re giving off the patterns. Over time, the company expanded its service offerings to commercial enterprises and the non-profit sector too, realizing they were facing similar challenges in working with large sets of data in a non-static way as much as the government did.

Since then, it has built four different software platforms: Gotham, Foundry, Apollo, and Artificial Intelligence Platform (‘AIP’). Gotham and Foundry enable institutions to transform massive amounts of information into an integrated data asset that reflects their operations, while AIP leverages Palantir’s existing machine learning (ML) technologies alongside large language models (‘LLMs’) within Gotham and Foundry to help connect AI to the user’s data.

Gotham is the platform used by governmental agencies such as defense, the intelligence community, disaster relief organizations and others. Foundry can be used as the central operating system for both individual companies as well as industries as a whole. Apollo, which is being offered commercially since 2021, is a cloud-agnostic, single control layer that coordinates ongoing delivery of new features, security updates, and platform configurations, helping ensure the continuous operation of critical systems. It basically allows Palantir’s clients to run its software in virtually any environment. Since 2023, it is offering AIP. It leverages the recent breakthroughs in AI by connecting its other existing platforms with LLMs and other AI, helping to facilitate data-driven operations decision-making. It allows people working with data to ask and answer complex questions without requiring them to master querying languages, statistical modeling, or the command line, thus creating a world-class user experience in the field of working with data.

The company’s mission is to support Western liberal democracies and its allies. Palantir prides itself in that it doesn’t enter into business with customers or governments whose positions or actions are considered inconsistent with this mission, even if this stance may hurt the company’s long-term financial results and growth prospects. They refuse doing business with the Russians, China, and Saudi Arabia, to name but a few.

Alex Karp, the company’s somewhat eccentric CEO, has made it very clear on numerous occasions that he feels its position shouldn’t be controversial but often is, especially in much of Silicon Valley but also abroad. As a consequence, he’s under a 24/7 security program, followed by a bodyguard everywhere he goes. The measures are meant to protect him from extremists who have sent him death threats and conspiracy theorists linking his company to the illuminati. Palantir lives the realities of some of its customers: the NSA, FBI, and CIA. It also was one of the first companies to help Ukraine after the Russian invasion and publicly stated it stood behind Israel after the Hamas terrorist attacks on 7 October 2023:

(Source: The New York Times, Sunday Oct. 15, 2023)

This company has clearly chosen sides and doesn’t shy away from owning up to it. Either you love them, or you hate them – there doesn’t seem to be much room for middle ground in today’s polarized society. This may prove to be part of its strength as well as its weakness, as it will put the firm under a constant stream of public criticism and suspicion. At the same time, its number of clients is going up rapidly and it has a raving investor fan base, much like the Tesla’s and Apples of this world.

Palantir wants to become the most important software company in the world. Where other software companies focus on targeted analytical tools and the optimization of specific functions within complex organizations, Palantir believes software should connect the entire enterprise. It prioritizes customer outcomes over short-term financial results by working directly with its customers to deploy its products, integrate their data, optimize workflows, and producing operational results in weeks or days, not years.

The company prides itself for being a non-hierarchical workplace with a culture of openness and a high degree of trust. It emphasizes collaboration, creativity, and problem-solving through encouraging its employees to take risks and think outside the box to come up with innovative solutions. Colleagues get merit-based responsibility fairly quickly, rather than through office politics or a standardized career path. Palantir has its quirks, with some employees describing the culture as ‘embracing the weirdness.’ A lot of references are being made to Lord of the Rings, where another employee has described the company’s mission is ‘to save the Shire.’

The company is run by CEO Alex Karp, who was also one of its co-founders together with Peter Thiel (now chairman of the Board of Directors). Karp holds a BA from Haverford College, a JD from Stanford (where he got to know Peter Thiel), and a PhD in philosophy from Goethe University in Frankfurt, Germany. He is not your typical tech CEO. Starting out as a neoclassical social theorist, he went on to found the London-based asset-management firm Caedmon Group in 2002 to then turn to Palantir in 2003. He’s a big, visionary leader and I could spend an entire blog on his morals, viewpoints, and predictive powers time has proven him right time and again. But for the sake of brevity, I’ll limit myself here by sharing only a few quotes of him that will give you a taste of his views and the mission of Palantir:

“It is instability, not its absence, that makes our software all the more essential. Our company is built for the world that is, not the world that ought to be.“

(…)

Software projects with our nation’s defense and intelligence agencies, whose missions are to keep us safe, have become controversial, while companies built on advertising dollars are commonplace. For many consumer internet companies, our thoughts and inclinations, behaviors and browsing habits, are the product for sale. The slogans and marketing of many of the Valley’s largest technology firms attempt to obscure this simple fact.

The world’s largest consumer internet companies have never had greater access to the most intimate aspects of our lives. And the advance of their technologies has outpaced the development of the forms of political control that are capable of governing their use.

(…)

Americans will remain tolerant of the idiosyncrasies and excesses of the Valley only to the extent that technology companies are building something substantial that serves the public interest. The corporate form itself – that is, the privilege to engage in private enterprise – is a product of the state and would not exist without it.

(…)

The ability of our most vital institutions to protect and provide for the public requires the right technology. And we believe that as a result, over the long term, the strength and survival of democratic forms of government do as well.”

(Source: Karp’s opening letter in Palantir’s S-1 filing)

Peter Thiel is one of the other co-founders of Palantir, now serving as chairman. He also co-founded PayPal and was the first outside investor in Facebook, where he served on the Board of Directors from 2005-2022. He is also a partner at Founders Fund, a Silicon Valley Venture Capital firm that has funded companies like SpaceX, AirBnB and many others. He’s also the author of the book Zero to One, which I can highly encourage anyone of you to read if you haven’t already.

Stephen Cohen is one of the other co-founders of the company and has served various positions since then. His most current position is that of President and Secretary and he is also a member of the Board of Directors since 2005. He holds a BS in Computer Science from Stanford.

Shyam Sankar joined Palantir in 2006 and is the company’s Chief-Technology-Officer and Executive Vice-President. He holds a BS in Electrical and Computer engineering from Cornell University and a MS in Management Science & Engineering from Stanford.

Palantir builds software platforms for large institutions that have to deal with big data. Through its two principal platforms, Gotham (for governments) and Foundry (commercial), it helps its users to identify patterns that lie hidden deep within their datasets and interact with it in a dynamic way. While most existing uses with data revolve around creating dashboards and reports for its users, that are often scattered across different systems, Gotham and Foundry have tried to find a way in which they could integrate data scientists and data analysts on the one hand with non-technical (business) analysts on the other, through the use of a so-called ontology. Instead of creating a data warehouse or a data lake, it rather sits on top of it.

(Source: Palantir website)

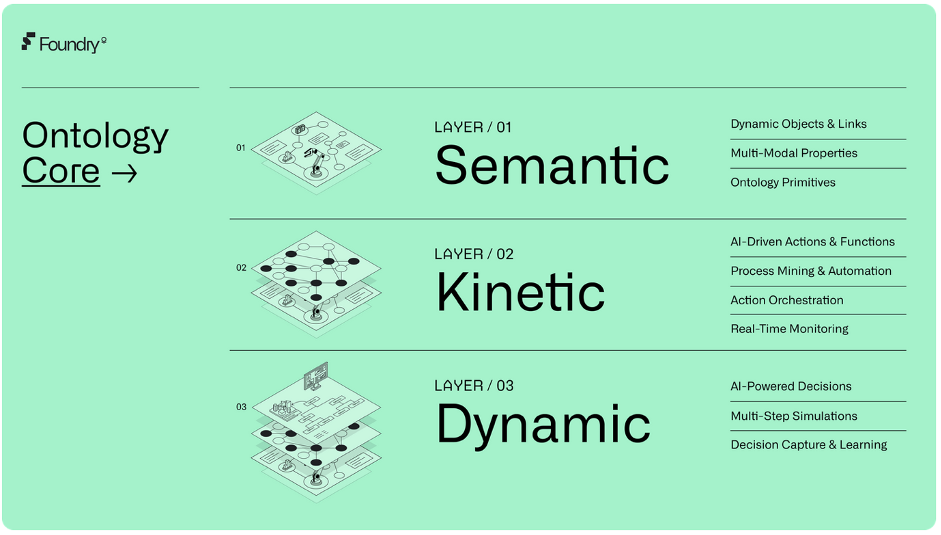

The ontology consists of three layers. Firstly, there are the semantics. These are the real-world elements of the business. Conceptual and object-oriented in nature. What does the business consist of? A warehouse, trucks, et cetera. Then there’s kinetics, which allows a business to define its behaviors, actions, and decisions. Through kinetics, automations, processes, and models can be put together and coordinated to run the business. Finally, the dynamics allow the user to run simulations across the organization to see the potential impact of the decisions that are being taken and to then take action based on that information.

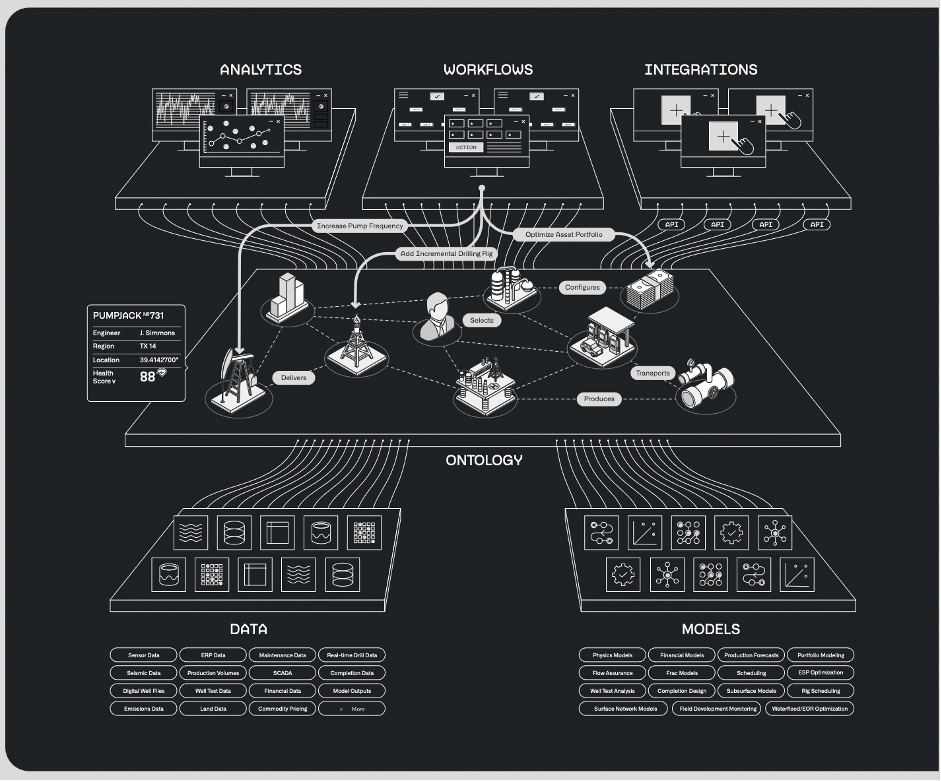

Below is a schematic overview of what an ontology looks like and how this actually works.

(Source: Palantir Business Update, Q4 2022)

If you look at it from the bottom left corner, it starts with the data, which have to be uploaded onto the Foundry software – a phase Palantir likes to call ‘hydrating Foundry’. Next come the models a company works with. These can be Machine Learning (ML) or Artificial Intelligence models, risk models, statistical tooling, propensity models and more.

Once these two are loaded onto the Ontology, a digital twin of the company is being created. Here, all the data and models are woven together in a simulated world that can then recommend the best course of action in real time, based on simulations about future outcomes in the analytics phase by AI. It makes recommendations to what actions the organization should take in order to have a competitive advantage in the case of uncertainty or disruption, thus creating alpha. As a user, you are then free to decide to execute the recommended course of action or not.

Examples you may think of here could be something like: ‘what would happen if I would raise my prices in my store by an X amount?’ Or: ‘What will be the effect of a strike on my assembly line for outcome Y?’

Alternatively, instead of human decisions based on the AI recommendation, the company can decide to create systems of action or workflows that take out the necessity to make human decisions altogether, having the apps that you build execute the task for you. These systems of action, or apps, can be created by non-technical users and does not require any coding skills. Thus, allowing the company to build apps that essentially run the business by itself. The main responsibility of management will then become to update the systems of action when necessary.

In Spring 2023, Palantir launched its new Artificial Intelligence Platform (AIP), which combines the ML technologies the company had already developed for industrial and military partners with the latest LLMs that became popular by the wider public after the launch of ChatGPT. AIP allows customers to leverage the power of ML technologies alongside the increasingly sophisticated natural language processing capabilities of the latest LLMs, directly in their existing Foundry or Gotham platforms.

This has opened up a whole new way of interacting with machines that was unknown up until now. Where before some degree of technical proficiency from users was required for them to be able to work with and extract valuable insights from large datasets, now, with AIP and its ML and natural language processing systems, anyone can now ask layered and complex questions in everyday English to Palantir’s platforms and extract the insights they need from it.

If you want to see what this can look like in practice, you should check out this video of how Palantir helps to enable AI in the auto industry at J.D. Power. They built aggregated data sets that define the inner workings of several industries, among which the auto industry (a $1 trillion industry). They look at things like: what cars can be built, what cars are actually being built, where are they being sent to, what cars are sitting on the parking lots at dealerships, when are they being sold, at what price, et cetera.

By studying these data, they have a good overview of the entire automotive industry. They spent many years doing things with the data sets they had, for example, apply machine learning in very domain specific models. Then they decided, about a year ago, to use AI with more conviction. From 2023 onward, they wanted to be an AI-first company. The use case is presented by Bernardo Rodriguez and is an absolute must-watch: https://www.youtube.com/watch?v=WrK0raIVAV8&t=5s

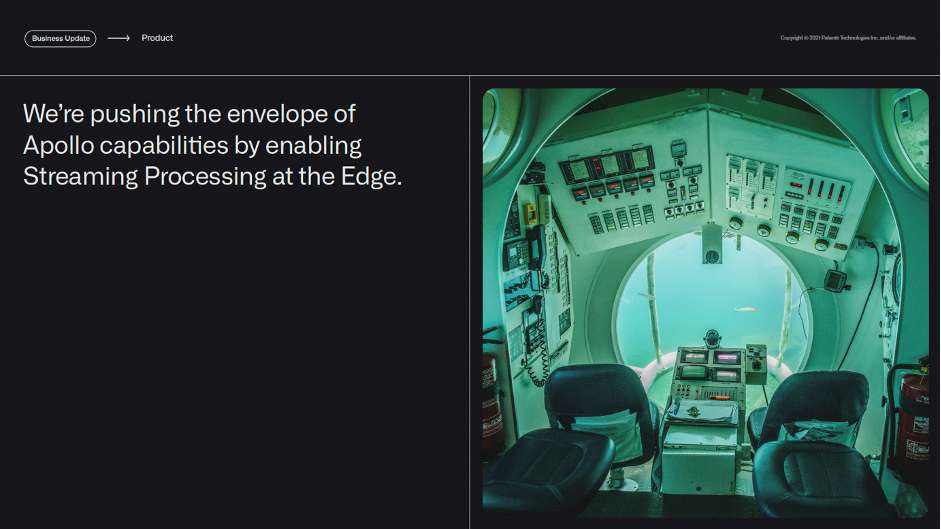

Apollo, its third platform, is a cloud-agnostic, single control layer that coordinates ongoing delivery of new features, security updates, and platform configurations, helping its users ensure the continuous operation of critical systems while allowing customers running their own software in virtually any environment. This aspect of Palantir’s services is often glanced over, but it’s a big thing when you think about it.

(Source: Palantir Business Update, Q3 2021)

As software is increasingly being run ‘at the edge,’ ranging from data centers to small form-factor devices on factory floors, in space, under the sea, or at other remote locations, deployment of software to these edge devices is often complex, especially at scale. And as compute moves increasingly out to the edge across industries, software deployment to the edge will become the key enabler to growing businesses.

Thanks to its years of experience in deploying its software in tightly controlled, often inaccessible places, Palantir has built its own solution for this edge software deployment. Through Apollo, Palantir enables its customers to deploy its software to any device, at any place, at scale. Customers increasingly require the ability to run, maintain, and upgrade software on dispersed devices with limited computing power that is disconnected from the network and this is where Apollo comes to the rescue.

Edge devices provide the greatest value when they can make rapid decisions based on a live stream of data. When computation happens at the edge, the latency problem is solved, speeding up the observation – decision-making – action loop. Moreover, deploying the software directly on edge devices reduces the risk of transmitting sensitive data through bandwidth-limited channels. The possibilities are enormous: from spotting defects in a manufacturing line, to predictive maintenance of oil pipelines to military intelligence, the benefits are great.

Palantir’s core mission is to ensure that its software is at the same time effective while never compromising on its core values. It wants to support Western liberal democracy and its strategic allies while protecting the civil liberties of free and democratic societies.

Since inception, the company’s platforms were built with the idea to deliver on its technological ability that empowers its software platforms to construct a model of the real world from countless data points, from which its customers can monitor, properly secure, and control access to the data and its use. It does so while simultaneously protecting individual privacy and the preventing of the misuse of information. This is the main reason why customers, including governments around the world, trust its platforms to safeguard their data, including its most sensitive information.

Contrary to popular belief in much of the media that talk about Palantir, the company takes civil liberties very seriously and conditional for their software to be deployed. In their early days, when fighting terrorism was their main objective, there was a common belief that the end would justify the means, even if tracking down terrorists and preventing attacks would mean sacrificing certain Western liberties and civic safeguards. Palantir took a different approach when they decided to track down terrorists while simultaneously protecting Western civil liberties. And this is also why they choose not to work with certain regimes that do not adhere to these principles.

Palantir’s business model used to be a three-stage rocket: with an acquire phase, an expand phase, and a scale phase.

During the acquire phase, it would target large-scale, hard-to-execute opportunities at large governmental and commercial organizations with complex data environments and high risk of failure. Where most other enterprise companies would avoid these prospective clients due to the nature of the task, Palantir actively seeks them out to go after. As this phase requires substantial human capital and financial resources, coupled with the fact there is no guarantee that the high upfront costs will ever translate into success, there aren’t many companies that are willing or able to bear such risks. This acts as a deterrent for potential competitors to emerge. The customer bears minimum risk, as the short-term pilot deployments of Palantir’s software platforms are often offered to them at little to no cost to have them experience the value of the software platforms first-hand before deciding to pay for them or not.

After the acquire phase, a significant additional investment by Palantir would follow in which it seeks to understand the key challenges faced by its newly onboarded customers and making sure its software delivers true value and tangible returns to its customers. The contract value will grow as more and more divisions, functions, users and/or groups within the organization will be included in using the software. By now, the software will have become ‘sticky’ as it will have become essential for running the business.

The third step is the scale phase, where customer spending continues to grow while the upfront investment on Palantir’s part has come to an end. The business begins to turn a profit for Palantir, as measured by the contribution margin, capturing how much Palantir has earned from customers after accounting for the costs associated with deploying and operating its software as well as any sales and marketing expenses needed in the acquire and expand phase for getting those clients.

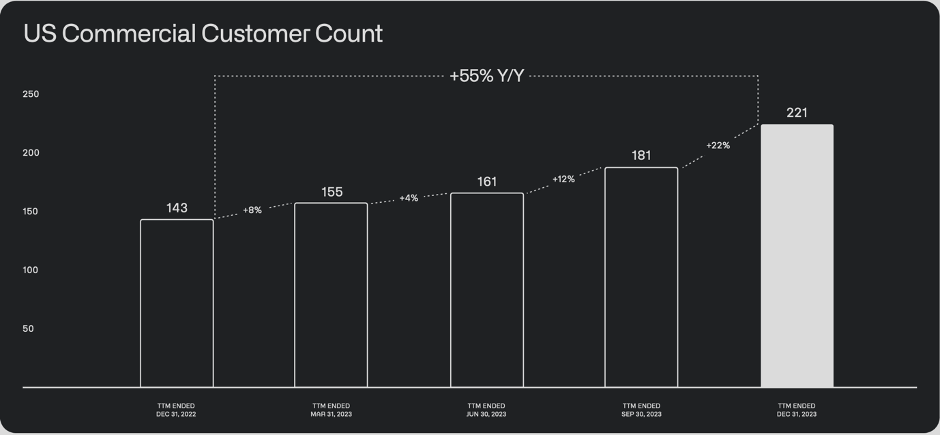

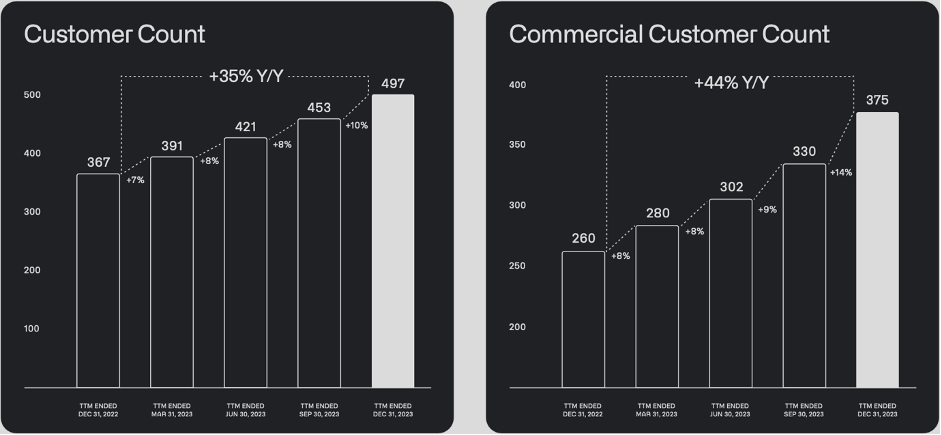

The speed with which its platforms can be deployed has improved dramatically since 2023 with the introduction of Palantir’s AIP bootcamps. This has allowed the company to deliver real workflows on actual customer data in days instead of months or years like it used to before. This has significantly expanded the range of potential customers with which they plan on partnering over the long term and management is anticipating their reach among an increasingly broad set of customers will accelerate moving forward. You can already see the number of US commercial customer count growth accelerating when comparing before and after AIP was launched mid-2023:

(Source: Business Update of Q4 2023)

(Source: ibid.)

To me, these are important metrics to keep monitoring going forward. I expect them to expand further in the coming quarters and years. Commercial revenue growth grew 32% YoY in Q4 2023 while government revenue grew by 11% YoY. For government contracts, the picture is more mixed and that’s because government is lumpy as it takes time to get bills passed and deals don’t come quarter by quarter but rather all at once.

As more and more of these new partners will start growing faster thanks to using Palantir’s software, Palantir is likely to grow along with them over time. Below is a tweet by Palantir’s CTO Shyam Sankar underscoring the effectiveness of AIP Bootcamps in enthusing potential customers for Palantir’s products by showcasing how quickly it can lead to new, valuable use cases that are custom made by and for the customer. As Palantir has been relentlessly focused on its product development, seeing is believing. And that’s what the AIP Bootcamps do:

(Source: Shyam Sankar, CTO of Palantir on X/Twitter)

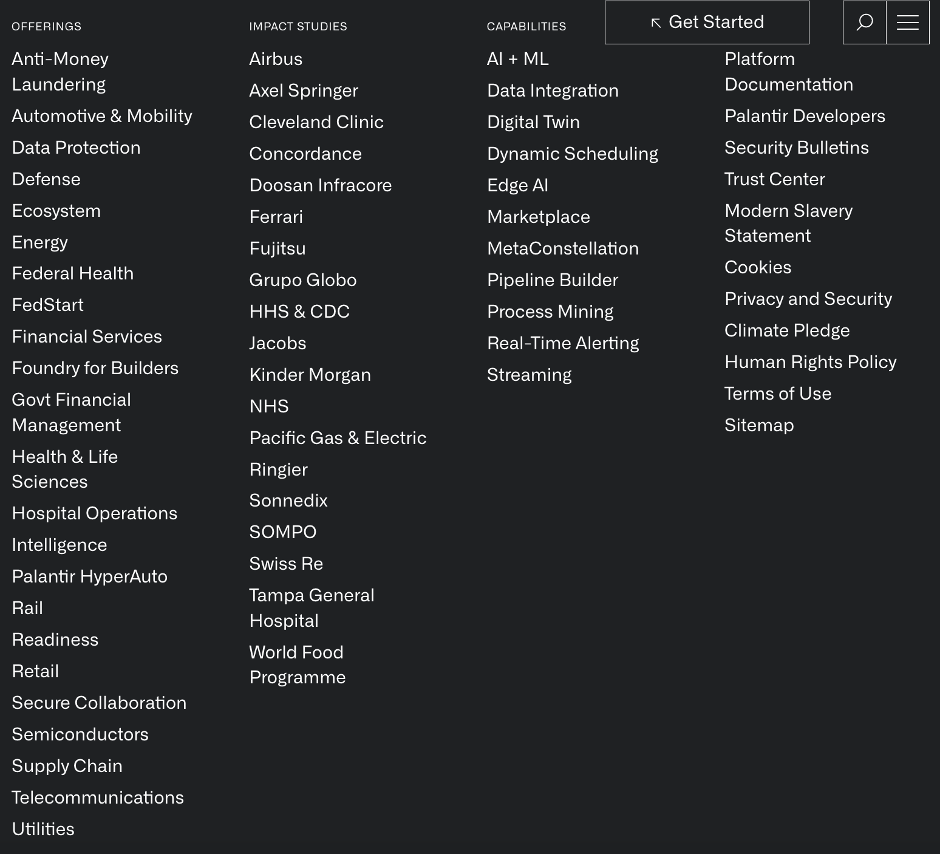

Palantir is serving more and more sectors and industries. This overview is from its website:

(Source: Palantir website)

From the start, Palantir has been relentless in its focus on its customers’ core problems. The fact that they are actively serving customers in the wide scope of industries as the list above illustrates, has given Palantir deep understanding of what its customers want and need. This has enabled them to create customized solutions to its clients offering them maximum value. The speed of innovation and its products’ capabilities are off the chart, making it hard to keep up with the pace this company is delivering new products and services.

Its use cases are truly amazing and have a big impact on its clients’ operations. Ranging from helping Ukraine in bringing 80% of land mine contaminated land back into use within the next 10 years to optimizing Australia-based Cole’s 840+ supermarket operations to helping the NHS in the UK in reducing their care backlog – they offer tremendous value and operational efficiencies for their clients. If you want to get a feel for the level of sophistication and impact its products have, I highly recommend watching these two videos:

https://youtu.be/1whh1mpLTFw?si=Yaq4Axz5MgnMVRly

https://www.youtube.com/watch?v=r8LtdKFcAvg&t=85s

Since inception, Palantir has worked closely with some of the world’s most demanding institutions regarding data safety and rigorous security standards. Due to the sensitivity of the nature of some of the businesses Palantir is engaged in together with their mission to help the West and its allies, privacy and civil liberties protection is at the heart of what they do. They realized from the start that if they would develop a product that would find the terrorists through sacrificing civil liberties, they would lose the support of half the society. But they also realized that if the terrorists would not be found, the radical right would be taking over Western societies.

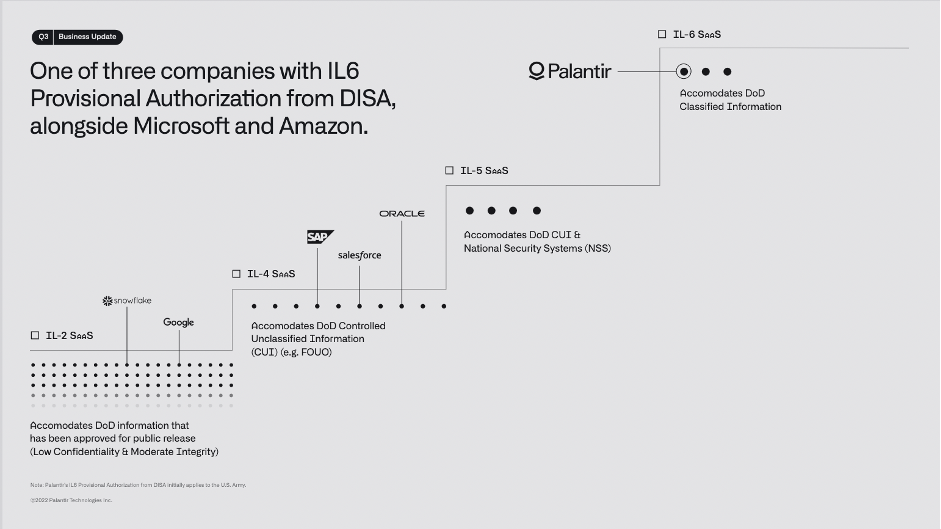

Contrary to popular belief, the company has gone to great lengths to make sure its products have built-in access controls and a secure environment for integrating and analyzing sensitive data. Its software comes with oversight and auditability design, so that the correct sensitive user actions within the system can be monitored and are in compliance with applicable policies and regulations. It complies to the strictest laws in the world regarding privacy and civil liberties, i.e., European Law, and it has received an Impact Level 6 (IL 6) authorization by the Defense Information Systems Agency (DISA) which has rigorous security and compliance standards required for its federal cloud service offering. By obtaining this IL 6 authorization, Palantir is only one out of three companies in the world with this clearance, next to Microsoft and Amazon Web Services (AWS).

(Source: Palantir Business Update Q3 2022)

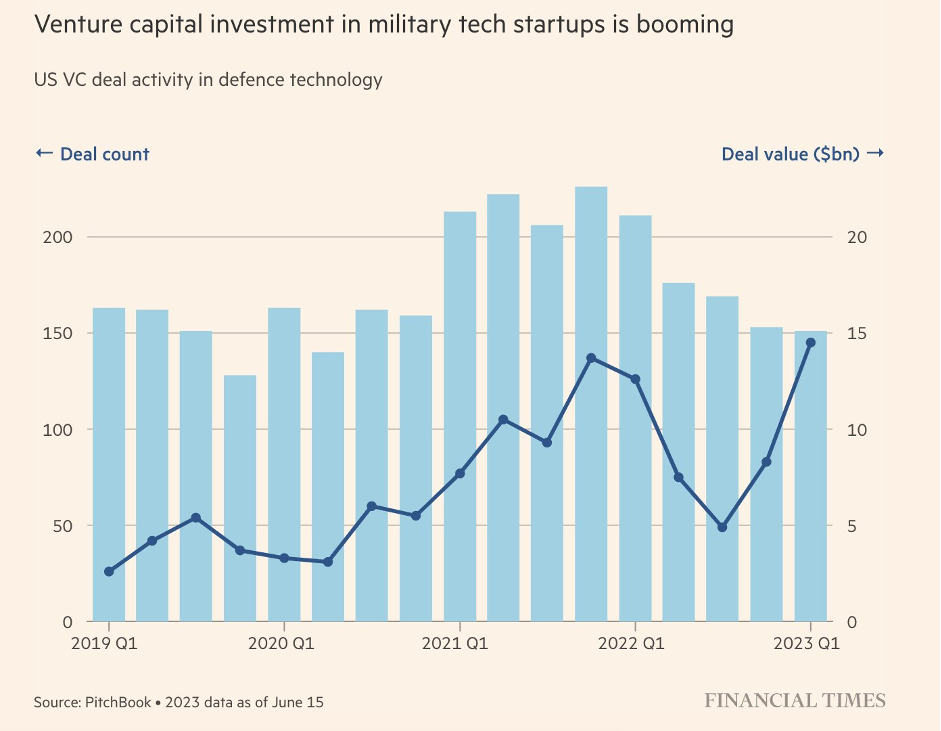

They can leverage this clearance by allowing other defense tech startups to get on the government networks through Palantir, using FedSTART – its SaaS (Software-as-a-Service) offering for eligible companies and startups that want to deploy their software to the federal government. This allows those companies to significantly accelerate their time-to-market by eliminating the need to pursue accreditation on their own which, on average, would take about 18 months at a cost of ~$2M. In September 2023, Palantir announced its Government Web Services (PGWS), enabling government tech innovators to use Palantir’s platforms. Its first three offerings are FedStart, Apollo, and Ontology SDKs (Software Development Kits – tools to build software that can be used on Palantir’s platform). The potential demand for this service may be huge, judging on the VC investment in military tech startups:

(Source: Financial Times)

This is the real differentiator to its competitors. Palantir is the only company that supports an ontology, meaning: datasets or data models that have relationships and behaviors. An event occurs in the system and you want that ontology object to respond to that event through taking an action. This actually mimics real world organizations, real world individuals, factories, behaviors and machines. Companies like Databricks don’t have this. You can build it, but it’s challenging to manage. Then there are the low code/no-code tools that come with Palantir’s software, removing the engineering bottleneck. Where usually a company would need a team of engineers to build custom data applications that actually do stuff, you can now have your product teams take care of that. It allows your non-technical staff to make decisions and extract value from the data, making everyone 10x more productive. It also takes away the need to hire data engineers or data scientists, which are in high demand and hard to get by (and are therefore highly paid).

Palantir’s products were designed to accommodate today’s problems. As the world is becoming less stable and, as a consequence, increasingly unpredictable (read: less globalized, with increased risk of war – as we’ve seen in Ukraine, Israel, and with the looming risk between China and Taiwan but also disruptive innovation in industries), the more valuable Palantir’s products become. When companies and governments can’t rely on old tactics and insights anymore, Palantir can help out by making sense of disparate datasets, to help companies make sense of it and act upon it with real-time data. Think about helping companies dealing with the challenges for supply chains globally during the Covid pandemic, that led to disrupting manufacturing sectors, for instance. But also, the disorder, risk, and uncertainty in a war situation. This company was not built for the world we would want it to be, but for the world as it is – and that world is becoming increasingly unpredictable, irregular, and random. Palantir was built with the idea to embrace randomness.

Palantir has been and for some still is a very controversial company. On numerous occasions, they have received bad press, either through traditional or on social media and investigative journalism blogs. The fact that they allegedly have helped the US track down Osama Bin Laden, the brain behind the 9/11 attacks and are now being used in Europe in the fight against terrorism or in Israel after the Oct. 7 attacks by Hamas, makes them an easy target. From an evil spy company to them not working in accordance to high privacy standards, data protection laws and security regulations: they’ve been accused of everything. It has also been a reason for some governments to choose to not work with them or cancel on contracts already entered into.

Germany being a case in point, or the nationwide protests in the UK in the run up to closing its deal with the UKs National Health Service (NHS) over fears of handling over patient data to a commercial corporation. Notwithstanding the fact that Palantir only uses the data to unlock valuable insights to its users (i.e., the medical staff working at the NHS) and not being able to use these data themselves, the public perception is at odds with this reality and has made it more difficult for the company to sell its products on certain occasions. Having said that, the NHS deal went through after a delay, and the Germans are being pressed by their police to start using Palantir again in the face of a heightened terrorist threat. But a risk for Palantir and its investors nonetheless.

Palantir relies heavily on a limited number of large customers. It derives a significant portion of its revenue from existing customers that expand their relationship with Palantir over time. It’s top-3 customers together account for 17-18% of its revenue for 2022-2023, respectively, and they have been with the company for an average of 8 years. This dependency makes the company vulnerable to significant fluctuations in revenue if these customers reduce their spending or terminate their contracts.

Generally, customers are offered terms of 1-5 years but sometimes customers enter into shorter term contracts. They have no obligation to renew, upgrade or expand their agreement with Palantir and many of the contracts allow for an early termination with notice periods varying from 3-6 months.

Data is the new oil in today’s age as they say. But data without the right tools to analyze and act on them isn’t worth much. For a big data platform to be meaningful, non-technical people need to be able to make data-driven decisions with it and extract value from it. Palantir is the only company that has managed to do this up until now. Palantir’s products are expensive, so the question then becomes: does your company have problems where solving them will offset the cost of using Palantir’s software products? If you can 10x the productivity of everyone at your company, the answer will often be a big ‘yes.’ Not for everyone, but a big portion of businesses out there can be counted as being part of Palantir’s total addressable market.

In a CNBC interview published Dec 5, 2022 by Palantir, Karp states America spends about $800B on software, but Palantir is also winning big deals in the UK and elsewhere and estimates its TAM is now north of $900 billion, and ever increasing. The percentage Palantir will be able to capture of that $900B will be large, with commercial products ‘flying off the shelves’ according to Karp.

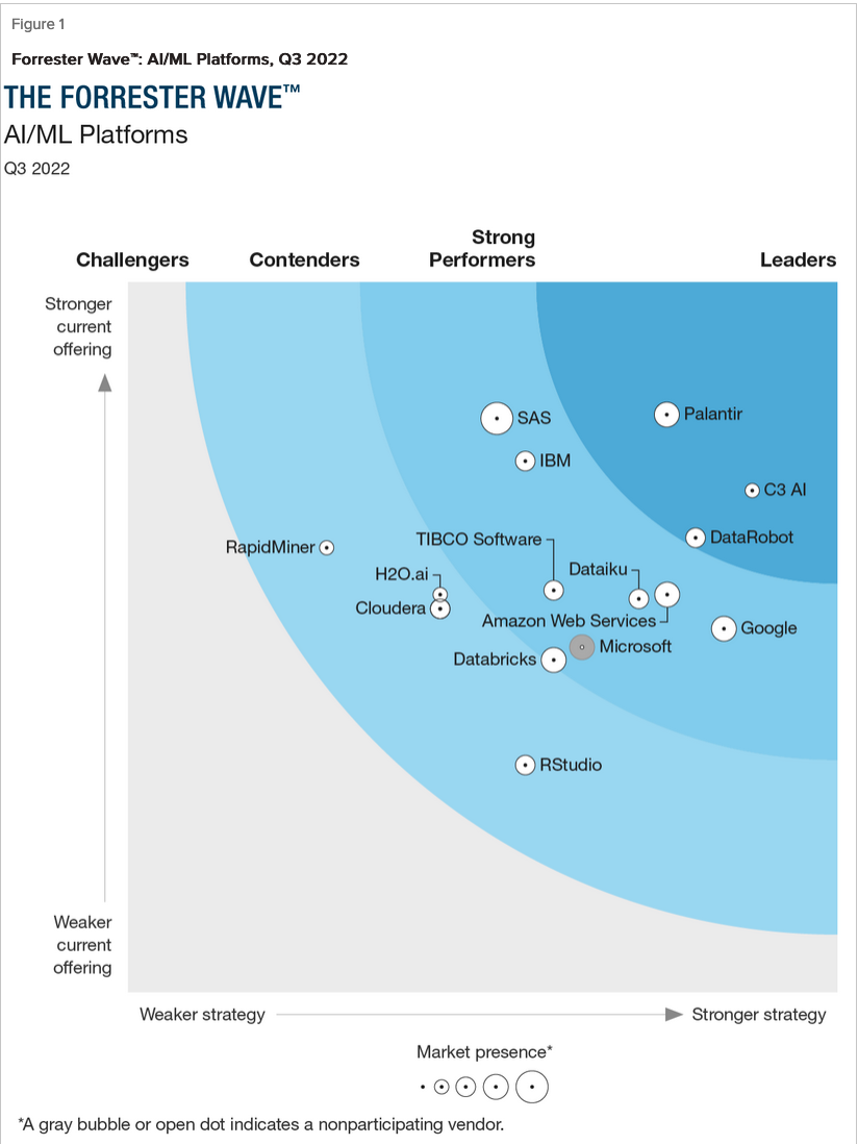

According to Fortune Business Insights, global big data analytics market size was valued at $272B in 2022, with a projected growth from $307B in 2023 to $745B by 2030, implying a 13.5% CAGR during the forecasted period. The market size for artificial intelligence is expected to show an annual growth rate of 15.8% from 2024-2030, resulting in a market volume of nearly $740B by 2030. When looking at the Forrester Wave on AI/ML Platforms, Palantir is the clear leader in this space:

(Source: Forrester Wave AI/ML Platforms, Q3, 2022)

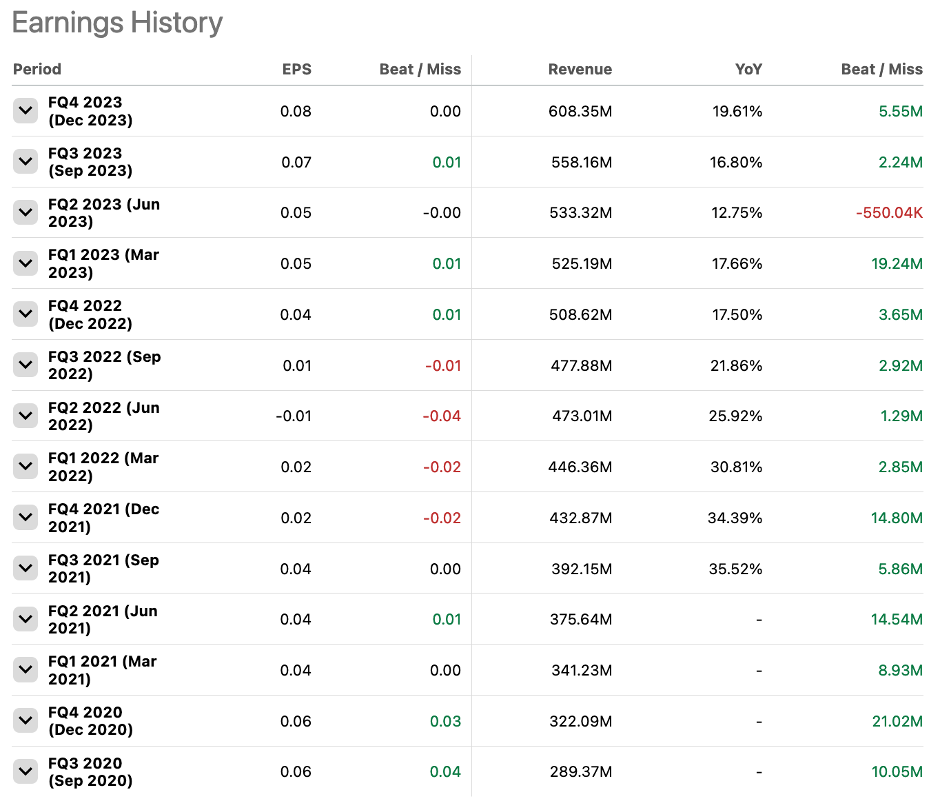

While revenue growth has slowed down for several quarters in the recent past, the company is trending upwards again since Q3 2023 and has a history of beating their own guidance. Given the recent developments since the launch of AIP Bootcamps, I am assuming this trend to continue for the foreseeable future, further accelerating the company into full growth mode again.

(Source: seekingalpha.com)

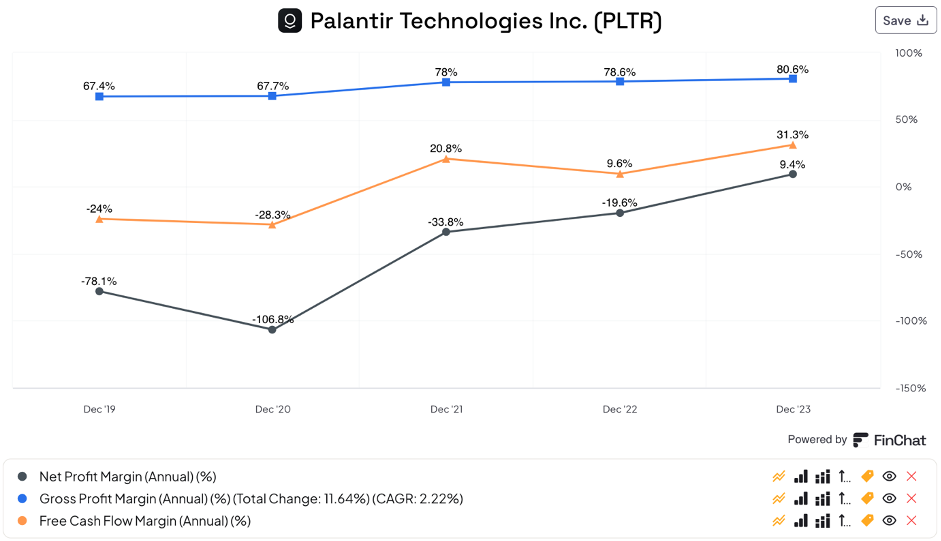

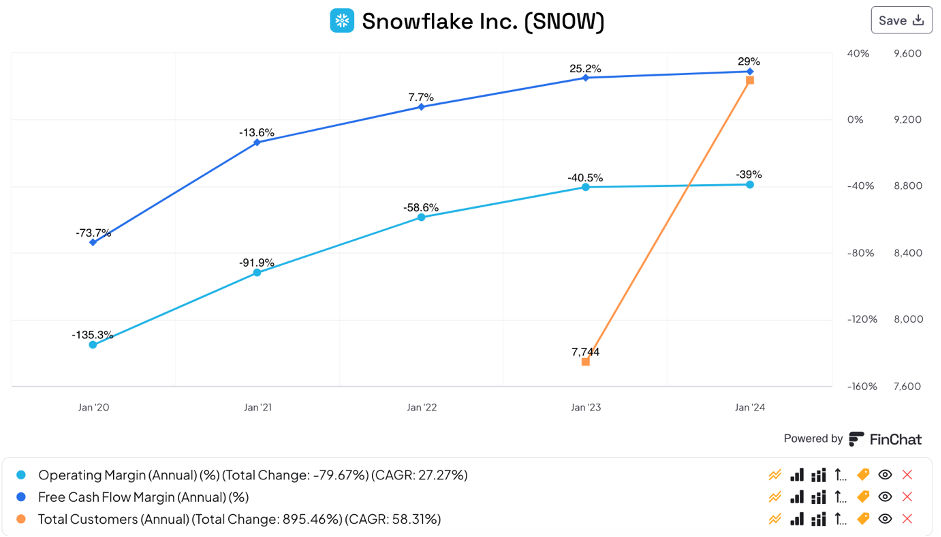

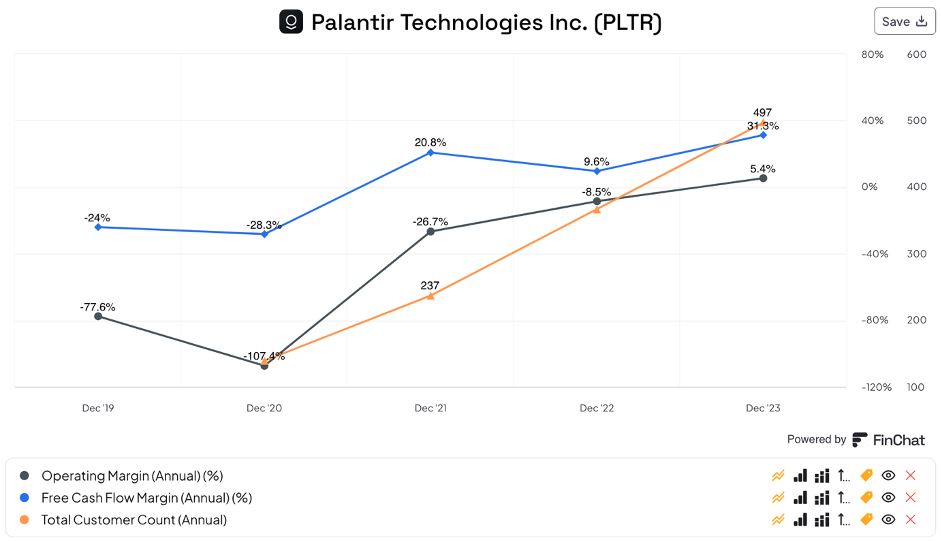

When comparing the last couple of years, Palantir is showing great operating leverage: net profit margins improved from -78.1% in 2021 to 9.4% in 2023, with free cash flow margins improving from -24% to 31.3% over the same period:

(Source: Finchat.io)

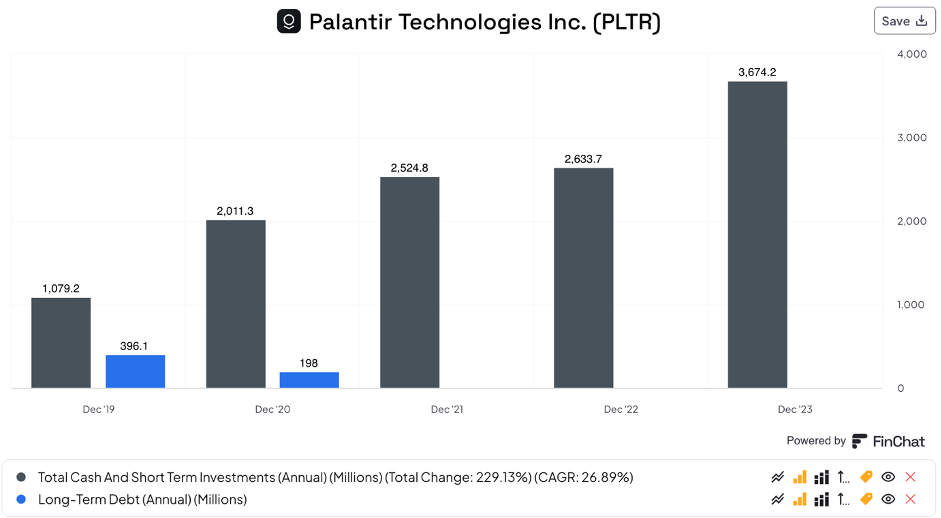

It has a strong balance sheet, with 3.7B in cash and no debt:

(Source: Finchat.io)

For my base case scenario, I will assume a total addressable market of $745B, staying at the lower end of the range given above. If Palantir continues to execute and keeps innovating and growing at its current pace, I think they may be well-positioned to capture a 15% market share over time, i.e., $112B in revenues. At a potential profit margin of 25% (the average for the software system & application industry being 19.1%) that would get them to a net profit of $28B, up from today’s $200M. At a future PE of 25 that would get the company to a future market cap of $698B.

For my bear case scenario, I assume the business to be ~30% off to the downside: instead of a TAM of $745B that would become $521.5B with a market share for Palantir of 11% and a profit margin potential of 18%. With a future PE of 17.5 that would get the company to a future market cap of $167.7B.

For the bull case scenario, I’m assuming the company will do better by about 30% to the upside: TAM would then become $968.5 with a potential market share of 20% and a potential profit margin of 33%. With a future PE of 32.5 that would get the company to a future market cap of $1,994.8B.

Assuming a 60% chance for the bear case scenario to happen (given the fact that only ~25% of businesses survived after the first 15 years of their existence), a 30% chance for the base case, and a 10% for the bull case, that gets us to a weighted average future market cap of ~$509B. That’s an upside of $460B from today’s market cap of $49.3B or a 47.6% CAGR.

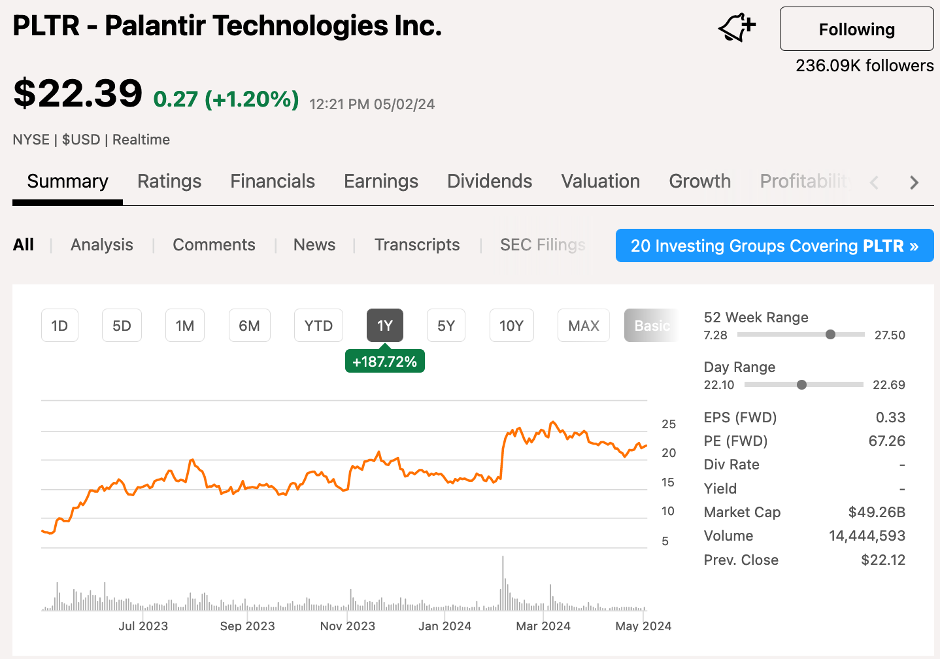

Palantir is trading at $22.39 as of May 2, 2024, up 187% over the past 12 months and trading near its 52-week high of $27.50, as is often the case with quality companies. While you might think that what goes up must come down, that often isn’t true. Mostly, winners keep on winning. Just like in life. Think of sportsmen, musicians, writers, actors. When they are the A-players in their field, they often remain being so for many years.

(Source: seekingalpha.com)

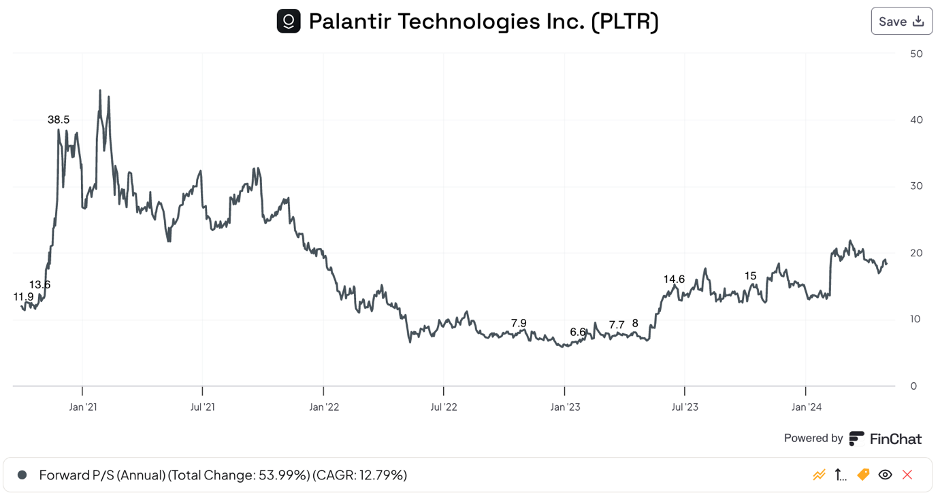

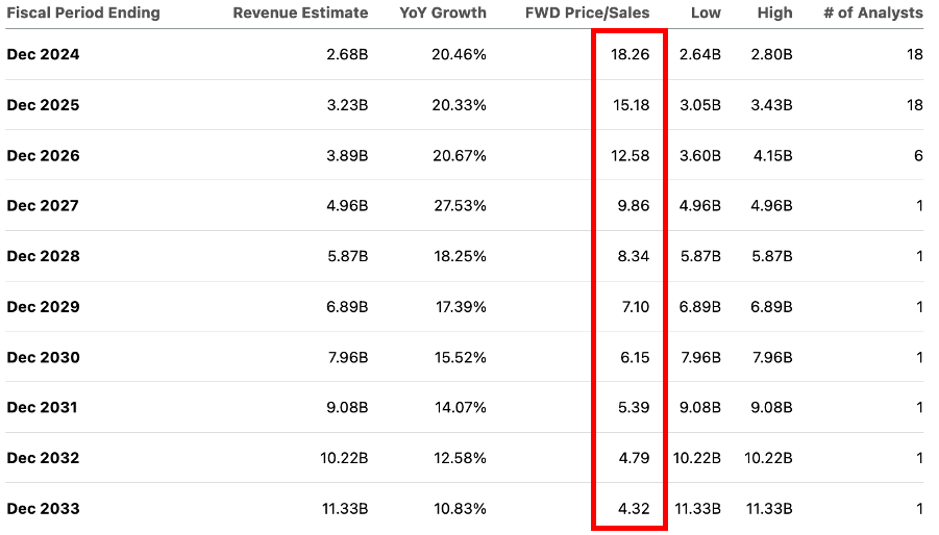

When looking at how the market is pricing Palantir, it is trading at a forward Price-to-sales ratio of 18.4. Down substantially from its 2021 levels, but still not cheap by any measure. Snowflake (ticker: SNOW), while not entirely comparable to Palantir, trades at a P/S (fwd) ratio of 15.2, which still isn’t exactly a bargain.

(Source: Finchat.io)

Of course, this ratio will come down if the company keeps growing:

(Source: seekingalpha.com)

Let’s see how they compare on a number of other metrics.

(Source: Finchat.io)

(Source: Finchat.io)

As you can see, both SNOW and PLTR are growing their total customer count at an impressive pace. Operating margin is improving for SNOW, but slowing down to -39% compared to 5.4% for PLTR. Free cash flow margin for SNOW is 29% compared to 31.3% for PLTR.

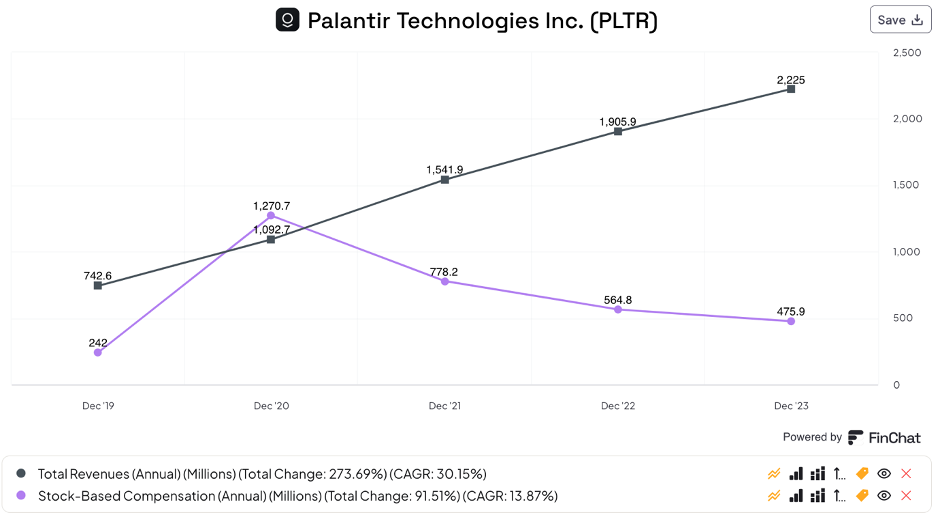

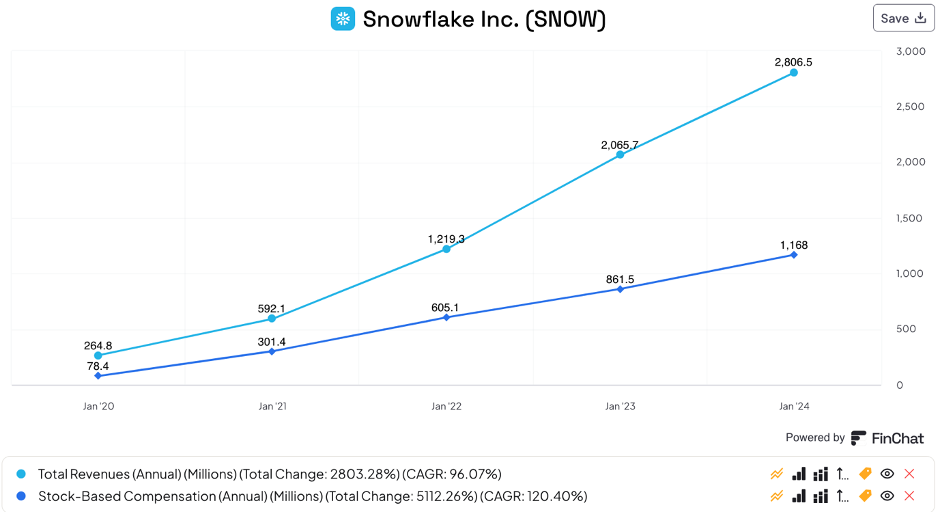

But while PLTRs revenues went up, its stock-based compensation has been steadily declining. Snowflake has seen its revenues skyrocket but so has its SBC. While it did decelerate from previous levels, it is still up 35.6% in 2023 YoY.

(Source: Finchat.io)

(Source: Finchat.io)

I think you can see the clear trend: while Snowflake is growing its customer count aggressively, its margins are flattening while SBC is going up. While Palantir is also growing its customer count, it shows improving margins with SBC coming down significantly.

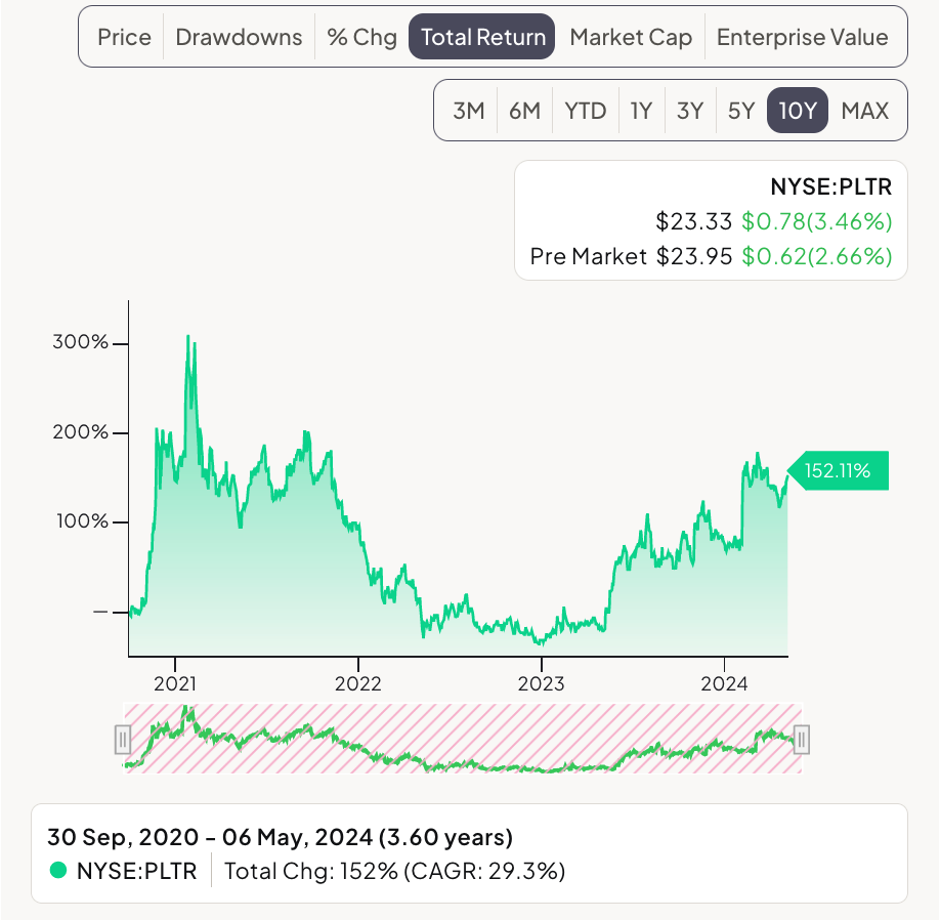

Let’s look at how the company has done on the stock market since going public. The stock is up 152% since September 30, 2020 or a 29.2% CAGR (compound annual growth rate).

(Source: Finchat.io)

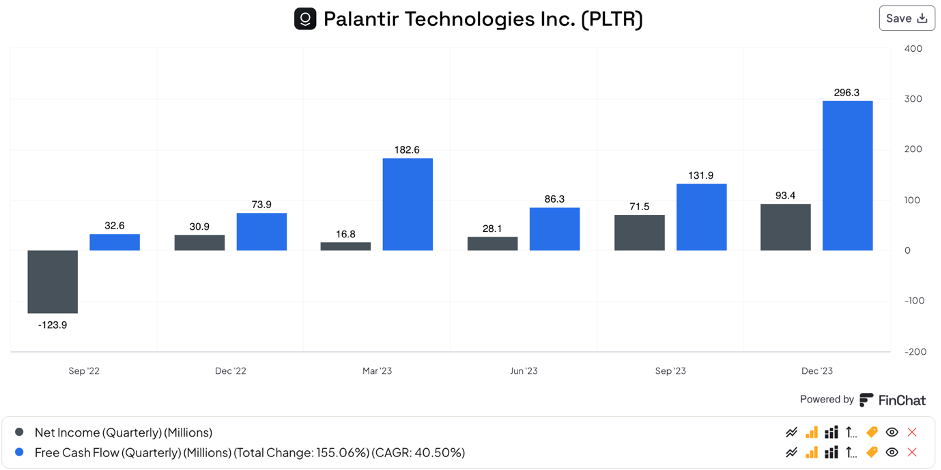

As you can see from the graph, the stock went up significantly after its low by the end of 2022. This coincides with the company turning net profits from December 2022 for each subsequent quarter since, with both net income and free cash flow moving further up and to the right:

(Source: Finchat.io)

The impact of AIP bootcamps since mid-2023 also becomes evident. Numbers from September 2023 onward show a reacceleration that I expect will continue moving forward and that I will monitor closely in the coming quarterly earnings.

Palantir is a mission-driven, founder-led company with an unrivalled product that helps its clients reach their goals much faster and more efficiently by providing real-time insights through its big data operating system platform. It’s deep industry specific knowledge and fast implementation capabilities also for non-technical staff, make this company a real game changer for every entity working with big data. I foresee a lot of growth going forward as this company has shown that it has figured out a way of providing insights, efficiencies and value through the use of AI and ML that many would have deemed impossible until recently.

For a long time, its sales have been unimpressive but with the launch of AIP bootcamps mid-2023, the company has turned the corner and we can see a reacceleration of growth. It will have to show it can keep doing so moving forward, but the signs are promising. The company is not cheap by any standard, but I see a big addressable market that will further expand over time, offering exponential growth possibilities for the long term with Palantir becoming the operating system from which to operate and build the companies that will be ready for the future.

I have a beneficial long position in the share(s) mentioned.

The information and publication above are not intended to be and do not constitute financial advice, investment advice, trading advice or any other advice or recommendation of any sort. Do your own research and seek independent advice when required. Investing carries risks.