Many investors get too hung up on the idea of timing the market exactly right when it comes to when you should invest in a certain stock. A couple of remarks on this.

no one knows what the market will do in a day, a week, a month, or a year from now. The ones that pretend to are lying to you, no matter how convincing they may sound. If even the Federal Reserve doesn't know what will happen next, how could you?

in line with the above: does it really matter what the market will do in a day, a week, a month, or a year from now if your investment horizon is 10+ years? Learn to focus on the long term, as we can't predict the short term.

What follows from this, is that you also don't need to invest all your money all at once. It's only natural to feel being in a rush caused by a fear of missing out if the stock goes up rapidly. But when you zoom out a bit, a couple of months won't make that much of a difference in the grand scheme of things. Especially knowing that the making of a 10-, 40-, or 100-bagger takes years.

With that out of the way, let's talk about dollar-cost-averaging (DCA) and why I think it's the wise thing to do when it comes to buying your stocks.

DCA is the practice where you decide ahead of time how much you are willing to invest in a certain stock, then cut that amount in equal sizes that you will use over an extended period of time. That could range from some months to a year to even several years. Generally, I invest the same amount of money each and every month and depending on the price the stock trades at for any given time, that means I can buy more of it when the stock is trading at a low price and less when it is trading at a higher price point.

This has a number of benefits:

For one thing, I take out much of the emotional aspect of investing as it takes out the guesswork. I don't know what the market will do tomorrow, nor do I have to. It doesn't matter in the grand scheme of things. I've shown you elsewhere that on average, every stock trades at such a wide price range that the difference between its 52 week high and its 52 week low lies around 50% each and every year. Knowing this for a fact, I won't have to worry if I'm buying at too high a price or not or missing out on a stock that will have a huge run up starting tomorrow.

Second, and more importantly, I limit my downside risk considerably by spreading out the time over which I buy into my position over time. Imagine I would want to invest $10,000 into one single stock and to do so all at once today, only to wake up tomorrow and find out that the market crashes. It would take years before I would be at break-even. Even though investing it all at once works out best in terms of how you'll get the most return on investment, it's not worth the risk of being wiped out the next day, no matter how small that chance may seem. As I said above: no one knows what the market will do tomorrow.

We may think we've considered each and every risk and feel like we know what will happen next, but no one saw Covid coming, or the 2007-2008 financial crisis, or the Dotcom bubble. Yes, we know in the abstract these things may occur. And we know these things happen every so often. But no one can tell you on what day it will start. In hindsight, everyone can be 20/20. Knowing it in advance is a different story. So, the best thing to do is build in a hedge to protect yourself. This is what DCA does for you.

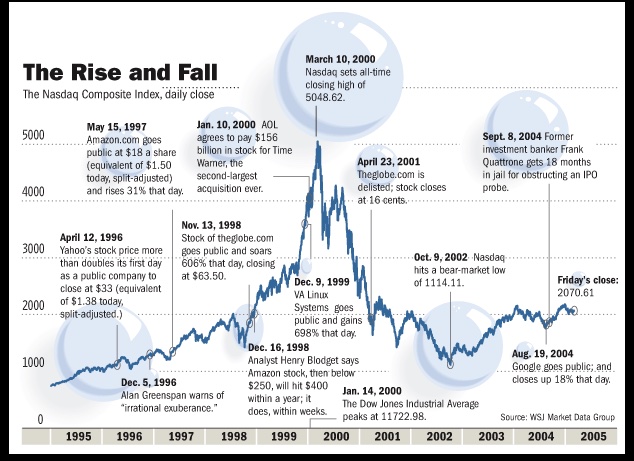

This goes for investing in growth stocks as much as it does for investing in an index tracker. Take a look at the following chart:

(Source: Jesse Colombo, Twitter/X: @TheBubbleBubble)

Imagine you would have invested in the Nasdaq on March 10, 2000 right at its all-time high of 5048.62. You wake up the next morning and see the market fall. Would you have sold? Probably not - as you wouldn't have known how deep it would fall or how long it would continue to fall. After 2.5 years the Nasdaq would have shrunk to its bear market low of 1114.11, a decline of 77.9%. Had you invested $10,000 on March 10, 2000 all at once, that would have left you with $2,210. It would have taken you until 15 May 2015 to recoup your losses - ~12,5 long years.

Now let's compare that to if you had been using DCA instead.

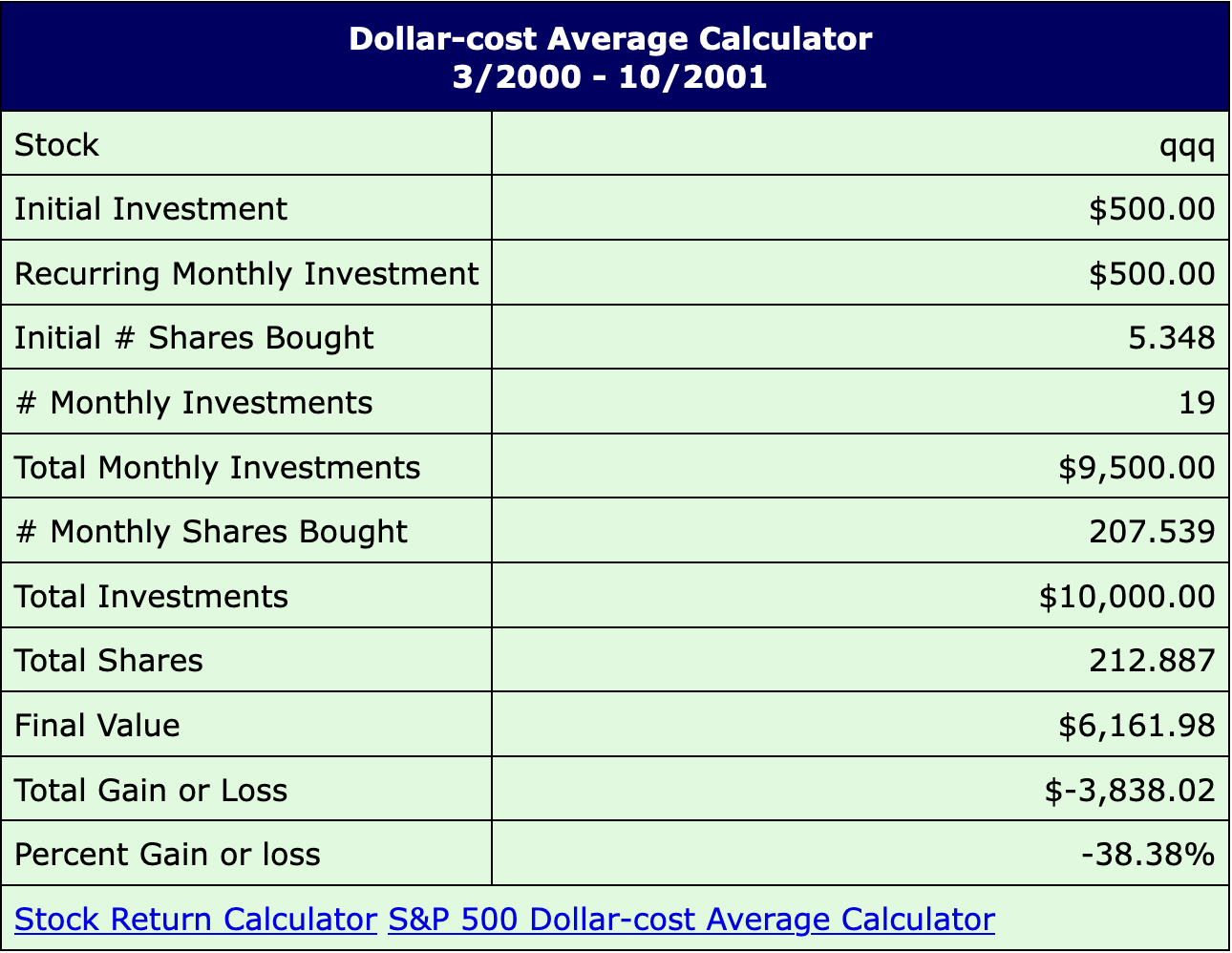

(Source: buyupside.com)

If you had not invested that $10,000 all at once in March 2000 but used it as a starting point with an initial $500 investment followed up with 20 monthly $500 additions to the Invesco QQQ Trust Series 1 (the Nasdaq tracker) you would have ended up with a final value of $6,161 or a -38.38% loss. Still painful, but much easier to turn back into green.

Resist the urge to go all-in at once, you've got plenty of time.