Published: 22 April 2024 by Imaël

On 16 April 2024, Fastned (FAST) released its Q1 2024 trading update. The stock was down -5.86% following this earnings update:

(Source: Yahoo finance)

The company reported revenue growth of €18.9M, up 42% YoY, with 31.4 GWh delivered during the quarter (+52% YoY) outgrowing the increase in EV stock of 42% in the markets it operates in. Gross profit for the quarter was €14.7M, up 56.4% YoY.

In early 2021 Fastned raised €150M via institutional investors for the first time. In Q4 ’23 €27.9M was raised via its retail bond program, funding the current construction pace of the company. In Q1 ’24 an additional €27.5M was raised through issuing new retail bonds.

The company expects underlying company EBITDA to become positive again during 2024 and to expand from last year, but doesn’t have the level of predictability to provide us with more detailed guidance at this stage. Still, with the strong continuation in network expansion investments which it expects to go up by 50% in the coming two years, management guides operational EBITDA margin to be above 40% by 2025.

Fastned opened 11 new stations during the quarter and secured 52 new high traffic locations (as many as for full year 2023), of which 34 new prime locations in the German highway tender and 18 private locations across Europe. While this was a significant growth, these numbers are not to be expected for the coming quarters. In total, it brings the total pipeline to 483 secured locations. By the end of Q1, 307 stations were active across its fast-charging network.

Energy delivered per station was 419 MWh during Q1 ’24, up 27% YoY but down from 447MWh (annualized) in Q4’23 and slightly below BEV fleet penetration growth of 32%. Annualized revenues per station were €252,000 up 17.8% YoY but down from €267,000 in Q4’23.

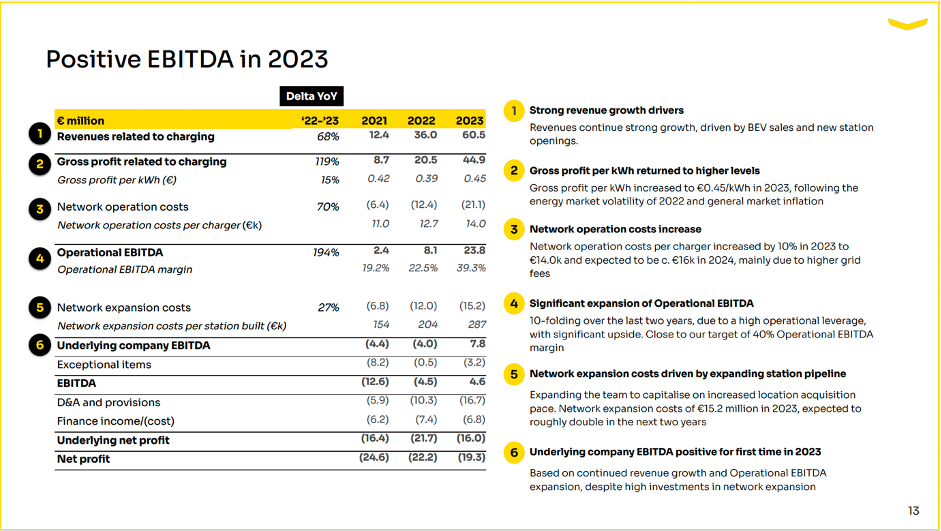

(Source: Fastned Q1 ’24 Trading Update Presentation)

Operational EBITDA, which includes all costs to operate the network, went up 10x since 2021 from €2.4M to €23.8M, while operational EBITDA margin increased from 19.2% in 2021 to 39.3% for 2023. With utilization rates currently at 13.5%, there is significant upward potential. Network expansion costs went up twofold from €6.8M in 2021 to €15.2 in 2023 and is expected to double in the next two years.

As sales volumes are going up, management has decided to sign its first Power Purchasing Agreement (PPA), allowing Fastned to deliver stable pricing for electric drivers as well as protecting its gross margins. Potential price increases for Fastned are capped, while the company will profit from a drop in energy prices too: win-win. Until recently, Fastned purchased its electricity volume on the wholesale market against spot prices.

Battery prices continue to improve, allowing car manufacturers to put more batteries in a car and giving it more range, or making EVs more affordable and allowing for selling cars in a lower price segment. This, in turn will further accelerate the transition to EVs from fossil fuel cars.

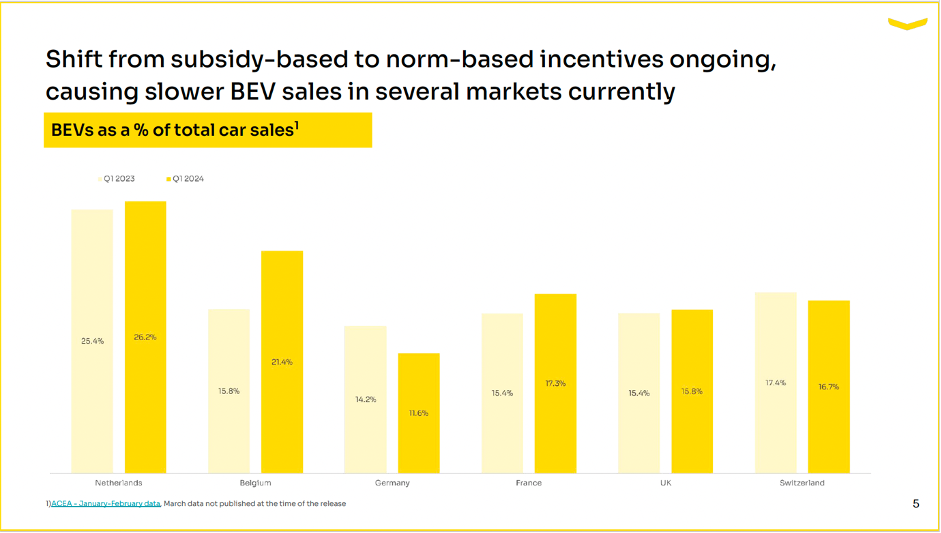

Still, BEV sales are slowing down in the markets Fastned operates in (see image below).

(Source: Fastned Q1 ’24 Trading Update Presentation)

Until recently, many countries had subsidies supporting the sales of EVs. When the percentage of new cars sold started hitting double digits, the scale of these subsidies is becoming in issue for most governments. That’s why governments across the EU are looking for new ways to support people in making a sustainable choice at scale. These new incentives are more norm-based. For example, in France several media wrote about the negative effects that will result from the government stopping the €3,000 ecological bonus for every EV. At the same time, taxation on new cars was again made stricter on CO2 emissions (which only made the headlines later on). Choosing a new company car in France to be fossil-fueled is now simply becoming an expensive decision.

There will be a short-term negative effect due to this changeover from one methodology of incentivization to the next, creating a feeling of fiscal instability among companies and consumers. But the long-term trend is clear and the full effect of the new incentives will play out towards more EV adoption rather than less.

Ambitions from tendering authorities, partners and grid operators have been higher than their ability to deliver on them. Tenders have been delayed several times and connections to the electricity grids are not realized faster despite demand being there. Overcoming these bottlenecks will lead to a softer construction pace for Fastned for 2024, expecting to increase again in 2025 and beyond. Fastned guides for 38 to 53 new stations opened in 2024, bringing the total number of operational stations by year end between 335 to 350. For 2025, it estimates that its network will have grown to 420-450 locations, up from their previous number of > 400 in 2025. It is worth noting that 95% of its secured locations historically has translated into stations built.

Still, assuming the low end of guidance with 335 stations operational by year end 2024, that means that for Fastned to reach its target of 1,000 stations operational by 2030 it would have to remain building over 110 stations annually.

When asked, management indicated grid congestion is having an effect on lead times in 10-15% of its sites, mainly in the Netherlands and the UK. For its other markets it expects this to start happening from next year onward. In the Netherlands, the congestion practically means that grid operators will need 2-3 years to upgrade their grids. While this will slow down the expansion of its operational stations in the short term, it also works as a valuable protection against competitors seeking to enter their markets as capacity is scarce.

For the Netherlands, about 50% of its network locations are up for renewal before 2030. This will most likely mean they will lose a significant amount of its sites here, as management expects to see win rates similar to what we see in other countries. But in an open and competitive market in the Netherlands, it can help Fastned convey the message to other countries that the situation should be similar elsewhere. With win rates remaining the same, it can be applied to many more markets, increasing Fastned’s overall network.

Will these factors pose a challenge for the company in the short to medium term? No doubt. Can it pull this off? I think so. It has invested strongly in its construction team that works on its preliminary works before starting the construction of stations in new markets. They have to contact grid operators, put the supply chain together, and request building permits before the actual building of stations can start.

Once this groundwork is laid out, the subsequent rollout can go relatively quickly. Of course, grid congestion issues don’t help but this is a problem that its competitors will have to put up with as well. It should get solved over time – as it’s a problem for society at large, not just for Fastned and its competitors. But it will mean a temporary slowdown.

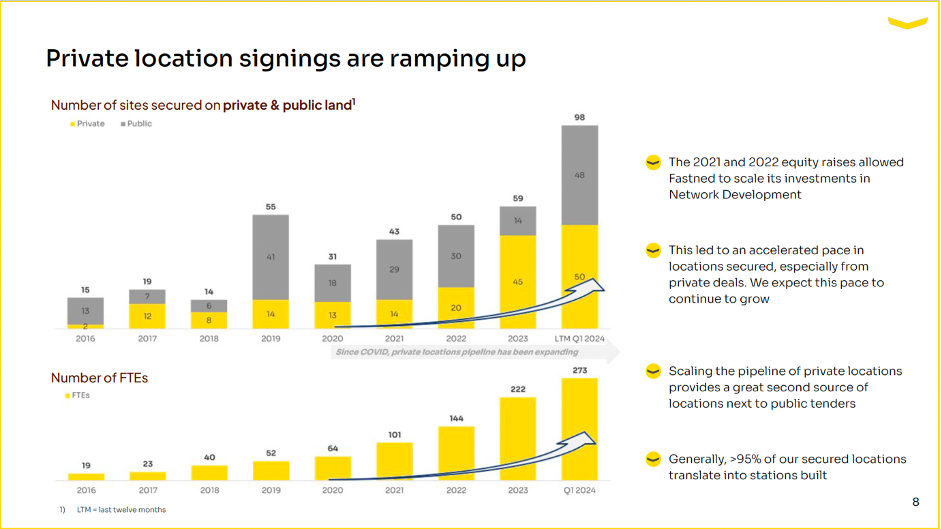

There are two main drivers behind the growth in Fastned’s secured pipeline of 483 locations, with 18 private sites signed this quarter alone (45 secured sites for the whole of 2023). First, the company has a significantly bigger network development team that is becoming effective at scale. Secondly, Fastned realizes market-leading station economics, allowing them to offer better rents on the real estate markets and pay leases for strategic high-traffic plots. This effect scales the area in which they can look for locations significantly while often not having to compete with other charging companies but with companies like Starbucks and McDonald’s and the likes.

(Source: Fastned Q1 ’24 Trading Update Presentation)

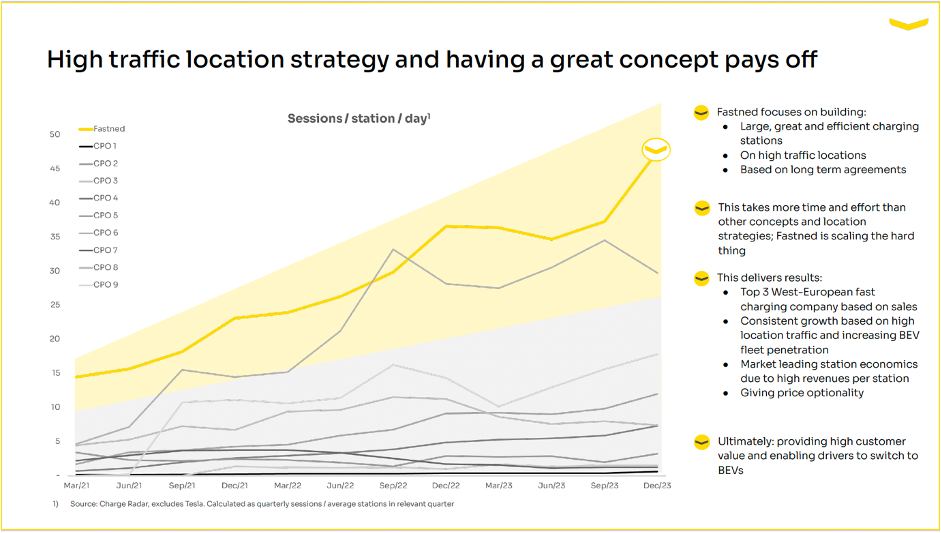

Then there’s one more important remark made during the earnings call by CEO Langezaal on being disciplined and selective that I want to share with you here. While other charging companies chase after as many locations as they can get whenever an opportunity provides itself (“spraying chargers”), Fastned is very selective in the ones that it wants and doesn’t want. To them, having the most locations is not the right measure of success. What truly matters is net present value. I think it’s worth showing visually what this looks like.

Below you see an image of Allego’s network of chargers, compared to that of Fastned. Under it, the business’ metrics. It is clear Fastned is way more efficient here, showing its strategy works.

(Source: Website Allego ‘Our Network’)

(Source: Fastned’s charging locations map)

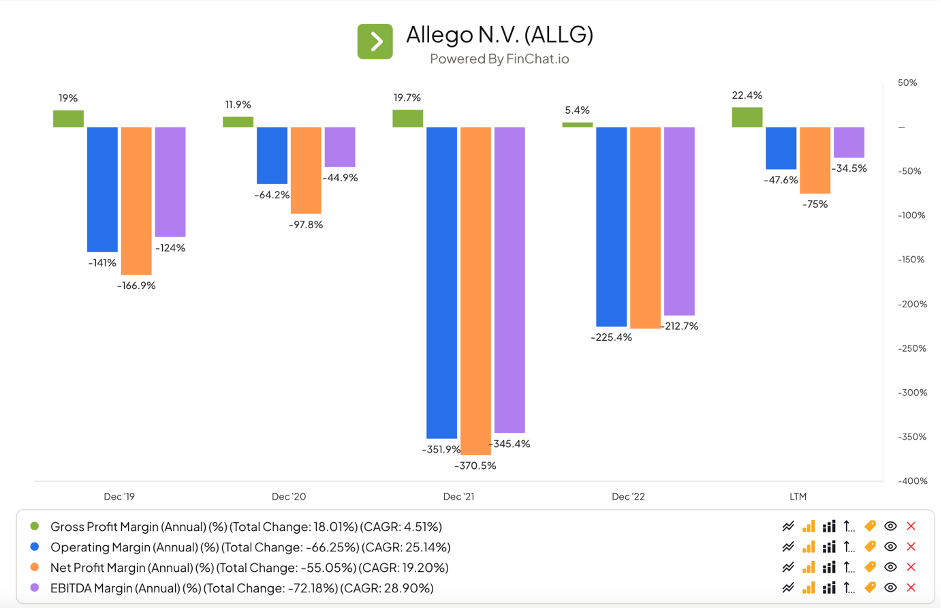

What stands out to me immediately when comparing these maps, is the much higher number of chargers scattered over the map at Allego compared to Fastned’s network. Now let’s look how that translates into their respective margins. Here are the ones from Allego:

(Source: finchat.io)

Gross margins have remained below 20% over the past 5 years except for the last twelve months, with operating and net margins deeply in the red (though improving quickly).

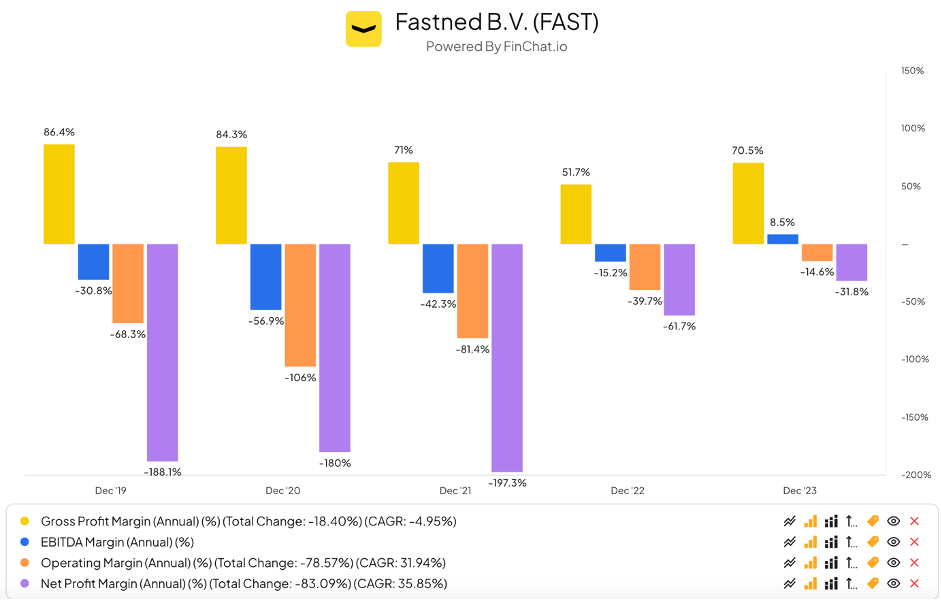

How does that compare to Fastned’s numbers? Let’s have a look:

(Source: finchat.io)

Gross margins came down from mid-80% in 2019 and 2020 but remain high at 70+% levels. Operating and net margins, while also still negative, are improving at a significantly higher 5-year CAGR of 31.9% and 35.9% respectively (vs. 25.1% and 19.2% for Allego’s numbers).

Many locations that become available through sharp bidding tenders offer practically returns. While they could win a lot of sites this way, its cumulative value would remain low. That’s why Fastned wants to only invest in infrastructure that creates real returns which they can use to fuel further growth.

This is why making serious investments in Italy under current conditions was not something Fastned wanted to engage in. As the Italian regulator and tenders require two charging companies per service area, sharing a revenue stream with contract tenures maximized at 12 years (in line with petrol stations), a serious business case could not be made here and so Fastned decided to not participate in a far majority of tenders there.

What it boils down to is this: because Fastned has a laser sharp focus on building large charging stations on high-traffic locations and operating them really well, they have managed to get predictable high session growth that scales with BEV fleet penetration, relatively independent of what other charging companies do on low traffic locations (see graph below, showing sessions per station per day growth). Fastned has grown into being a top-3 Western European fast charging company in terms of sales. (Not in number of chargers deployed!)

(Source: Fastned Q1 ’24 Trading Update Presentation)

Because of this, Fastned could keep its pricing relatively stable, while growing its profitability. Many of the other top-10 fast charging companies had to increase their prices over the last quarter, well-above Fastned’s pricing. That’s a consequence of their lower sales and thus, lower profitability. That’s also why I don’t really mind about the slower than anticipated growth of operational stations by the end of this year or not participating in the Italian tender. Quality above quantity.

In that regard, I particularly liked what I heard the CEO say in response to analyst’s question during the earnings call about Fastned entering the Polish market. The analyst wanted to know if, given Poland’s low EV penetration, there would be sufficient demand for fast-charging to turn stations profitable there. Here’s what Michiel Langezaal answered:

“That's a good question. So we looked at that, let's say, in more detail. I think we also need to learn in such markets. What we see, I think, with Poland is that compared to other countries, the car fleet stock is significantly larger with a larger, let's say, duration of car staying in the country, so they're older. We're talking about, let's say, 40,000,000 cars with an average lifespan of 40 or 50 years.

On the other hand, we also see quite fast economic development, whereby there is, let's say, a certain percentage of these cars is new. So there's actually new car sales, which are higher than the Netherlands. And what we also see is that those cars are more expensive cars more often. What we see generally across our market is that more expensive cars are more often electric. So what we see is basically that there is an environment whereby, let's say, with lower EV penetration, we could actually see very favorable economics at our stations.”

To me, this shows the long-term perspective of Fastned’s management which I really like. Perhaps Poland will transition to EV adoption (much) later than other EU countries, with a current BEV fleet penetration of 2.8% against 10.7% in the Netherlands as per the 2022 numbers (source: Acea ‘Vehicles on European Roads, February 2024). But the potential volume is huge. Add to that the fact that tenders in Poland are long – about 20 plus 5 plus 5 order of magnitude.

Management has issued a more conservative guidance for 2024 as compared to its Q4 2023 Trading Update. Where management guided for over 350 stations operational by year end 2024, they are now guiding for 335-350 stations operational by the end of this year. For 2025 they foresee a reacceleration from Q4 guidance: from 400 stations operational in 2025 to 420-450 today. Revenue per station was left unchanged at €400,000 in 2025 and >€1M by 2030. Operational EBITDA margin outlook for 2025 was left unchanged as well at >40% with underlying company EBITDA positive, and expected to expand from 2023-levels.

The stock price has come down from €28.95 to €23.10 over the past three months, with P/S coming down from 8.4 in Dec ’23 to 7.3 today. While I expect the stock may trade at these lower levels for some time given management’s lower guidance, I think its long-term story hasn’t changed in any meaningful way. Average station performance keeps improving YoY was down compared to Q4’23. A similar pattern to last year’s situation. We will have to wait for Q2 to see if the downtrend will continue or not. The picture is mixed.

As a long-term investor I consider it a buy at today’s prices but I do expect some slowdown moving forward. Given lowered guidance due to market trends as described above, I wouldn’t be surprised if the stock will trade sideways for quite some time from here onwards. Grid congestion issues will take some years before they will be resolved, first in the Netherlands and the UK, then starting in other markets too. Management expects it will lose a significant part of its Dutch network due to new tenders upcoming, and the new incentives models coming into play may cause some short-term slowdown of further EV adoption. At the same time, Chinese EV makers will offer cheaper EVs that will accelerate the transition towards electric mobility, reaccelerating Fastned’s growth trajectory.

I have a beneficial long position in the share(s) mentioned.

The information and publication above are not intended to be and do not constitute financial advice, investment advice, trading advice or any other advice or recommendation of any sort. Do your own research and seek independent advice when required. Investing carries risks.