Q2 Earnings Update Palantir (PLTR)

Published: 21 August 2024 by Imaël

Q2 2024 Earnings Update Palantir (PLTR)

Published: 21 August 2024 by Imaël

On August 5 Palantir released its Q2 earnings update after hours and the stock shot up since from $24.15 to $29.11 when I started writing this article. That’s a 20.5% increase in less than a week. As I didn’t get around finishing it sooner, the stock has gone up even more since then, to $32.54 as of today. Let’s dive in to see what the company has reported.

(Source: seekingalpha.com)

Palantir reported revenue of $678.1M for Q2, up 27.2% Y/Y and +7% sequentially, beating the estimates by $25.7M. EPS came in at $0.09, beating consensus by $0.01 and up 80% Y/Y.

Gross profit was $550M, up 29.1% Y/Y with an 81% gross margin, up 8 bps Y/Y. Operating income was $105M, up 950% Y/Y with an operating margin of 15.5% up 1364 bps Y/Y. The company is showing real operating leverage here, which is what we want to see as investors. Net profit came in at $134M, up 378% Y/Y with a net margin of 19.8%, up 1451 bps Y/Y. Just great! Free cash flow was $141M, up 63.7% Y/Y with a free cash flow margin of 20.8%.

Adjusted income from operations, which excludes stock-based compensation and employer payroll taxes was $254M with an adjusted operating margin of 37%. Adjusted free cash flow (excluding SBC-related employer payroll taxes) was $149M, yielding an adjusted FCF margin of 22%.

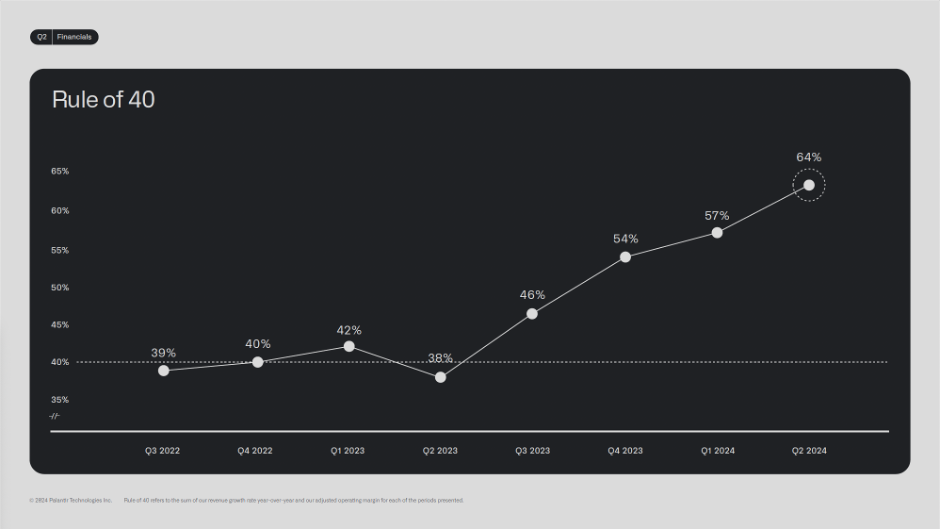

Palantir managed to pass the Rule of 40 bar comfortably again this quarter with a score of 64%. I think you can clearly see the trend here:

(Source: Palantir Business Update Q2 2024)

But as I already mentioned in my earnings review of Q1, I prefer the more conservative calculation of the Rule of 40 here, so on an unadjusted basis. That would give us a score of 42.7% instead of 64%. Much lower than what management communicates, but passing the bar and so, good enough for me (and remember – using this more conservative approach, Palantir scored only 33.8% just a quarter ago, so still an impressive improvement quarter-over-quarter).

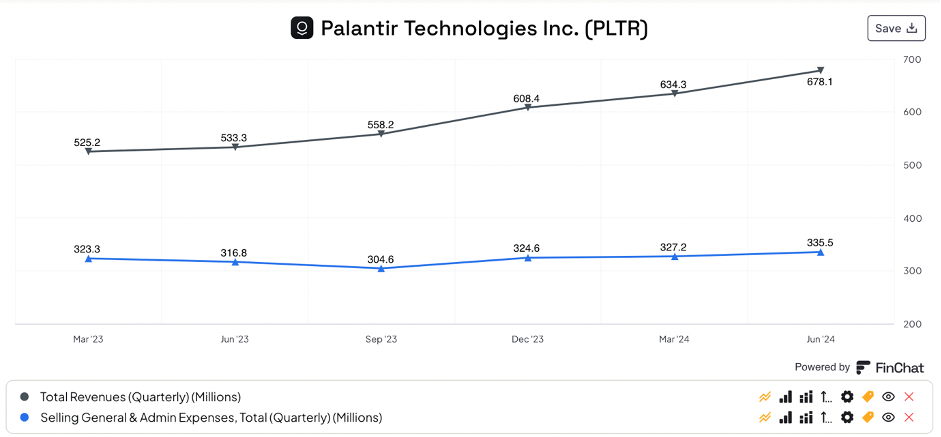

When we compare total revenues with costs for sales and marketing (SG&A), we get the following picture:

(Source: Finchat.io)

While revenue went up over the last six quarters, SG&A expenses remained relatively flat over the same period, where SG&A as a percentage of revenue went from 61.5% in Q1 2023 to 49.6% for Q2 2024. This means the product is basically starting to sell itself and sales efficiency is increasing.

This also shows in the increasing operating margin over time: while only 0.8% in Q1 2023, Palantir reported an operating margin of 15.5% in the current quarter.

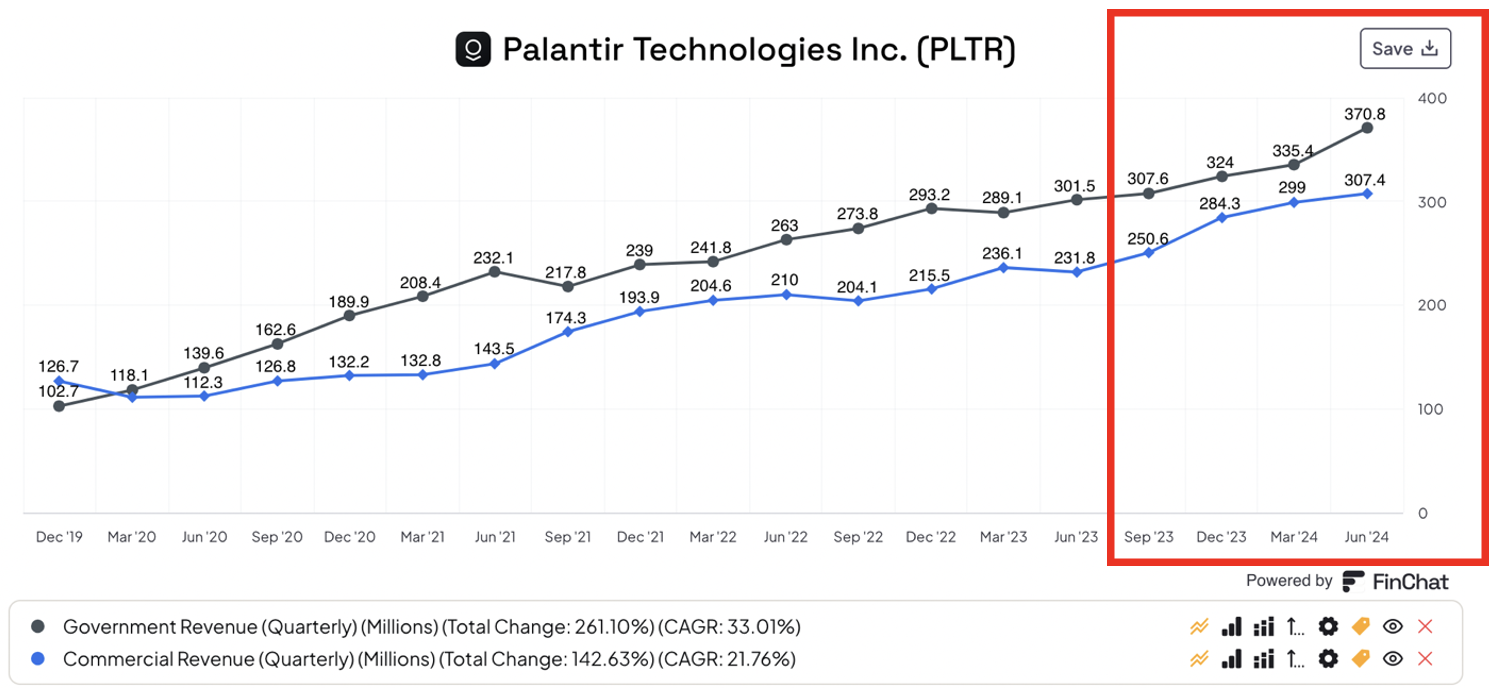

When we dissect Palantir’s revenue of $678M by its key segments, we see commercial was good for $307M this quarter (+32% Y/Y). Its government segment came in at $371M (+23% Y/Y).

(Source: Finchat.io)

As you can see on the chart above, commercial revenue accelerated from Q3 2023 onwards, showing the impact of the AIP launch and the importance of Palantir’s boot camps where potential customers can test drive Palantir’s AIP before buying. It provides them with an opportunity to get a hands-on experience with real-world applications, showcasing immediate value and thus, accelerating the adoption process.

Or, as Ryan Taylor said on the earnings call:

“Bootcamps are an important part of that motion. We’re seeing them expose customers to new opportunities and new potential customers to opportunities.”

From the graph above, we can see this strategy is starting to pay off. From its Q2 Business Update, Palantir states that since launching AIP in mid-2023 over 1,025 organizations in the US and worldwide have completed AIP bootcamps to date. I believe this will further accelerate going forward, as customers attending a Palantir bootcamp can host their own events for their own customers, showing off the software and teaching people how to use it, allowing the model to proliferate virtually indefinitely. I’ll keep monitoring if and how this plays out in the numbers going forward, but I wouldn’t be surprised to see the trend improving in the right direction.

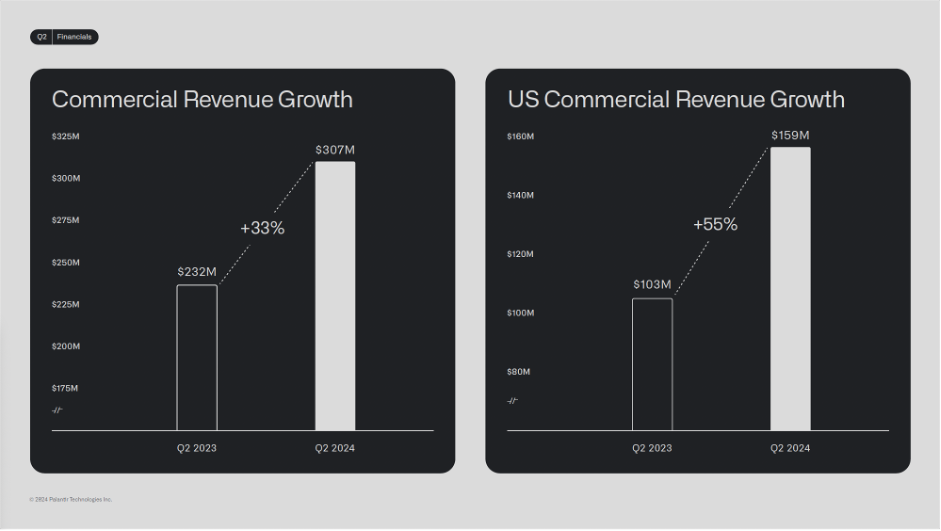

A hint at what this might look like starts to emerge when we look at the following numbers:

When offsetting US commercial revenue growth against overall commercial revenue growth you can see that Palantir’s products are really taking of in the US, with a 55% increase Y/Y vs +33% for commercial overall. At $159M, US commercial represents 51.8% of total commercial revenue. Great to see this segment is growing at such a fast pace, and very promising for the quarters ahead.

(Source: Palantir Business Update Q2 2024)

(For government revenue growth, the difference is much less pronounced. Overall government revenue increased 23% Y/Y to $371M, while US government revenue grew at 24% Y/Y. This is also understandable, given the fact that US government revenue represents 74.9% of total government spending for Palantir.)

Total customer count for the trailing twelve months grew 41% Y/Y to 593 customers, of which 467 were commercial (+55% Y/Y) with 295 from the US (+83% Y/Y).

During Q2, Palantir closed 96 deals of at least $1M, 33 of which were at least $5M, 27 of which were at least $10M.

On to its cash position. Palantir held a cash reserve of $4B (up from $3.9B in Q1) with still no long-term debt. During the three and six months ended June 30, management did $17.7M and $26.7M in share buybacks, respectively, retiring 2 million stocks under the Share Repurchase Program. As of June 30, approximately $973.3M of the originally authorized amount under the Share Repurchase Program remains available for future buybacks of its outstanding Class A common stock. This goes to show management executed on a small portion of its buyback program, but I like the signal.

Total RPO (remaining performance obligations, which is a reflection of the values of contracts that have been entered into by government and commercial customers and are non-cancelable revenue not yet recognized) increased to $1.37B (+41.2% Y/Y), signaling faster revenue recognition and higher contract value.

Below I’ve curated some of the highlights from the earnings call that I think are worth mentioning. Here’s Ryan Taylor, chief Revenue Officer and Chief Legal Officer speaking about the bottleneck that’s facing the AI ecosystem’s infrastructure:

“There's a great bottleneck between prototype and production. The world has also come to understand what we've been saying all along. The standard playbook does not and will not work. It cannot solve this problem. While many companies can build prototypes, the leap from prototype to production is substantial. Palantir has made that leap. Our focus is on deploying enterprise AI in production, solving meaningful problems for our customers. We have the right products at the right time and our history means that we understand the $600 billion opportunity unlike anyone else in this space. We are uniquely situated and you see that in our results now.”

The company saw a rise in volume of existing customers signing expansion deals, many of which as a result of AIP. US commercial is impacted by this most significantly as we could already see in the numbers above with US commercial. Some notable customers:

Tampa General, signing a 7-year expansion, deploying AIP to deliver a care coordination operating system where Palantir helped them reduce patient length of stay by 30%;

Panasonic Energy of N-America, signing a 3-year expansion, using AIP across finance, quality control, and manufacturing operations;

AARP, Eaton, Kinder Morgan were some of the other significant enterprise expansions mentioned during the call.

“One of America's leading hospitals began working with us in 2021, generated approximately $1.5 million of revenue in 2022, over $4 million of revenue in 2023, and is on track to generate nearly $15 million of revenue this year.”

Helping drive these kinds of results will ensure Palantir will sign many more expansion deals with existing customers going forward, I’m sure. Shyam Sankar, Palantir’s CTO, explained what makes Palantir find itself in pole position:

“The bottleneck and the transition from prototype to production is a very hard set of technical problems. We didn't build those technologies eating berries in San Francisco. We had to be on the factory floor in the foxhole, eating pain with our customers, seeing the secret truths of what does and doesn't work and metabolizing it into product. This has always been the secret of Palantir. It is the anti-playbook.”

During the company’s Q & A, one of the analysts, Mariana Perez Mora, asked about a new product from Palantir, called Warp Speed. She wanted to know what it is and how it could help power American reindustrialization. Here is what Shyam Sankar replied:

“So, with Warp Speed, it really is a – we conceive of it as an operating system for the modern American manufacturer. It touches not just ERP, but also MES, PLM, PLCs,* it’s interacting with the factory floor (…) I think the kind of congenital defect for most of this software, it was designed historically in the 70s for the CFO. Why would you do that?”

*) these are all abbreviations for business IT systems:

ERP = enterprise resource planning

MES = manufacturing execution systems

PLM = product lifecycle management

PLC = programmable logic controller

Sankar continues:

[The legacy software playbook doesn’t work anymore.] “If you go to new manufacturers, the ones that are powering the reindustrialization of the country, they all know this. They’re all alumni of the Tesla, SpaceX world where they built their own systems from scratch, principally because the other stuff doesn’t work at all. And they also know they can’t afford the 300 engineers it would take to build this completely from scratch or the time it would take to do that. So this is a very powerful role of taking AIP, building the applications on top of it using the OSDK [= Ontology Software Development Kit, basically providing a toolkit for building APIs for a business, in the language of that business], and delivering the integrated suite of applications that are also malleable to the business because I think one of the other key insights here is, it’s not actually believable that the same ERP manufacturing system that you use to build rockets is what you would use to build rackets.”

For those of you who have read the biography of Elon Musk by Walter Isaacson and how his companies have innovated from first principle thinking, this should sound familiar and reassuring with regards to the financial outlook of Palantir moving forward. I believe it is the most effective way if you want to escape the stagnation manufacturing companies are going through. Add to that the fact that much of the ever-increasing rate of new software doesn’t seem to have any real impact on the economic productivity of the manufacturing firms it should be helping and I think it becomes clear why Palantir seems very well-positioned to fill this void and to get rewarded for it accordingly.

Management raised its revenue guidance to $697-$701M for Q3 and adjusted income from operations between $233-$237M.

Revenue guidance raised to between $2,742-$2,750B. US commercial revenue guidance raise in excess of $672M, representing a growth rate of at least 47%. Adjusted income from operations guidance is raised to $966-$974M, with adjusted free cash flow remaining between $800M-$1B with GAAP operating income and net income remaining positive for each quarter 2024.

Management said during the earnings call they expect expenses to ramp up in the second half of the year due to investments in the product pipeline and in solving the technical issues that come with debottlenecking the journey from prototype to production – the theme of this call. At the same time, they will remain focused on calibrating the expense growth below revenue growth to continue delivering on its sustained GAAP profitability and operating income. At the same time, they expect cash flow to ramp in H2, in line with the expected timing of government and commercial year-end collections.

The stock is now trading at $32.30, up almost 50% from the levels right after the Q1 earnings came out. At a forward P/S of 23.9 (vs. a P/S of 16.5 a quarter ago), the stock price has increased quite a lot. The stock is up over 120% Y/Y. Is this warranted, given the new earnings report? Revenue increased 27% Y/Y and the company has shown a reacceleration since its low point in Q2 2023 (where its revenue growth was only 12.8% Y/Y). If the company manages to maintain current levels of revenue growth or slightly more around the 30% range, the stock seems fairly priced, but then again, as a long-term investor it shouldn’t matter too much whether it would be fairly priced or somewhat overvalued as long as the thesis remains intact. This quarter strongly confirmed that to be the case.

I see no reason to assume a slowdown anytime soon given the effect of AIP bootcamps when it comes to customer acquisitions and expansion with existing customers. Commercial revenue was up 33% and with US commercial growing at 55% Y/Y in particular, I think it is fair to say they’re delivering meaningful results to their clients and they are clearly recognizing that. With RPO up over 41% Y/Y, management has shown its previous statements were no exaggerations and that they delivered. With new innovations like Warp Speed and OSDK and the announcement of further investments in its product pipeline and the debottlenecking of the journey from prototype to production in H2, I think it is fair to assume management will keep executing and that the acquisition of new customers as well as expanding existing client contracts will only continue to grow further moving forward.

I have a beneficial long position in the share(s) mentioned.

The information and publication above are not intended to be and do not constitute financial advice, investment advice, trading advice or any other advice or recommendation of any sort. Do your own research and seek independent advice when required. Investing carries risks.