When you are just starting out with investing, your first stock will make up 100% of your entire portfolio. In order to limit your downside risk in case your stock later turns out to be a bad investment, it's important to diversify. The question is: how much diversification should you be aiming for?

As I've explained elsewhere volatility and risk are not the same thing. Volatility is about price swings (both up and down) of your stocks, risk is the prospect of a permanent loss of capital. Regarding risk, there are only two ways in which you can lose your money. The first is when you sell at a moment when your stock is trading for less than you paid for it. The second is when the company you invested in goes bankrupt.

That is to say risk is not absent - no matter how well you've done your homework. Even the best investors don't get a 10/10. In this business, if you get 4 stocks out of 10 that beat the market, you're doing great. One or two of them can make up for all the losses combined from your other stock picks. And then some.

Opinions on how much diversification is recommended vary on whom you ask and on your personality and particular situation. When you've done your proper research, know what you're investing in and why, diversification makes less sense than if you're less knowledgeable on a company's specifics. Having said that, it isn't safe to just own stock and go all-in.

Of course, there is a tradeoff here. The more you diversify, the harder it will become to keep tabs on all of your positions in a meaningful way. But no matter how well you've done your homework, there will always be the risk that your investment thesis doesn't play out as planned.

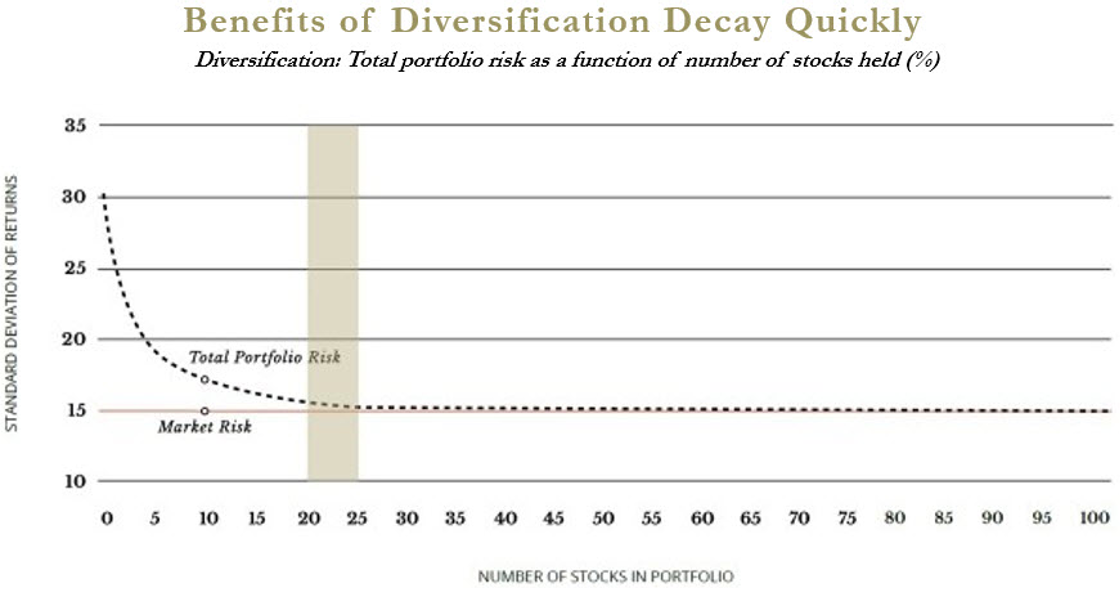

(Source: moiglobal.com)

This chart, based on the data from Malkiel's A Random Walk Down Wall Street, suggests that once your portfolio reaches a certain number of stocks, you'll approach the overall market volatility. Personally, I don't buy this as I think quality will always trump the market. To my mind, you should invest in as many stocks as you feel you are able to keep an eye on without losing the important details. The only reason why a more diversified portfolio would approximate the market average would be if you 'blind pick' your stocks:

"Investors have been so oversold on diversification that fear of having too many eggs in one basket has caused them to put far too little into companies they thoroughly know and far too much in others which they know nothing about." - Phil Fisher, 1958

During his time as a fund manager at Magellan (1977-1990), Peter Lynch grew the fund from US$20 million to over US$14 billion in 13 years, averaging a 29.2% annual return on investment (before fees). When he joined, he had about 60 stocks. By 1989 Magellan held 1,400 stocks.

Personally, I like to have a percentage in mind for each of the stocks in my portfolio. Depending on my conviction in a company, I am willing to add more to my position size. If I have 20 companies in my portfolio, I will start from the idea to have 5% positions for each one of them once the position is filled.

What do I mean by this? I like to scale into what I consider a "full" position slowly over time, which may take me a year or even longer. Like with relationships, you don't go all in on your first date but you build trust over time, building more conviction the longer you are following the company. For companies that get a high conviction rating from me, I may be willing to add more than the average "full" position. For companies that I have less conviction in, I may add less.

The next thing you should think about is what to do with your winners. Over time, some stocks will make up a bigger part of your overall portfolio as the company keeps executing. And while you should let your winners run as a general rule of thumb (at least for as long as the company keeps performing well), there may come a time when your position will become so large as a percentage of your overall portfolio that you may wish to trim your position. Again, the specific percentage here depends on your personality and personal situation.

If you can't sleep at night knowing that one of your stocks makes up 30% of your entire portfolio, it may be wise to trim it down to a position you're more comfortable with, knowing it could go down by 30-50% at some point in time again.

At Mindful Investing Insights I invest solely in growth stocks, but of course, your situation may be different from mine and I could imagine a situation in which you decide that you would allocate 1/3 of your overall portfolio to growth stocks (cost basis), one third in cyclicals for instance, and one third in an index tracker or something along those lines.

Lastly, you may want to keep some dry powder in the form of cash on the sides in case you see a significant market drop or an individual stock going down while your conviction in the company hasn't changed. You can then use your cash position to double down on the opportunity when it presents itself. Generally, I am fully invested but again: this is a personal matter.

If you want to read more on why I take such a long time to build my positions you can click on the link below where I explain the concept and my reasons for dollar-cost-averaging.